|

| Photo Credit: VANGUARD NEW |

Showing posts with label Aliko Dangote. Show all posts

Showing posts with label Aliko Dangote. Show all posts

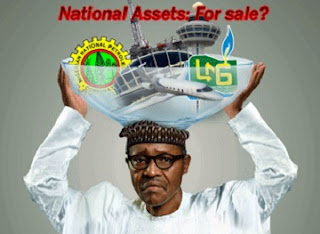

Nigeria FINISHED If Buhari Sells NLNG - Prof. David-West; ... Says He Should Rather Sell Off The Whole Nigerians

News Proof 23.9.16 No comments Edit Post

He described them as unpatriotic and enemies of Nigeria.

In an interview with Daily Sun in Ibadan, David-West said the clamour showed lack of understanding of the current economic quagmire. The former petroleum minister, who described oil and gas sector as the blood of the nation, said the clamour for outright selling of Nigeria Liquefied Natural Gas (NLNG), the country’s shares in the company or the refineries was a wrong way to tackle the economic recession.

Business mogul, Alhaji Aliko Dangote recently called for the sale of the nation’s shares in the NLNG. His suggestion received a buy in from the Senate President, Dr. Bukola Saraki who said the shares, along with other sovereign assets in the oil and aviation sectors be sold to stem the current economic recession.

But while David-West agreed that the country was in a desperate situation, he said the leadership should not be desperate towards providing solution to the challenges.

“It’s madness to say you want to sell NLNG and the refineries. Why not say Nigeria, too, should be sold?

“Yes recession is biting, and it is a desperate situation. But, anyone who acts desperately in a desperate situation will be in more trouble. If you have a desperate situation, don’t act desperately. When you act desperately, you are going to make more mistakes.

“In any case, oil and gas are strategic national assets, so, anyone who talks about selling them is unpatriotic. Oil makes up 90 percent of Nigerian foreign earnings. About 80 percent of our annual budget in this country is from oil. Oil is the life blood of Nigeria. Anyone that says go and sell oil asset, which is a strategic asset, is not patriotic, or does not understand what he’s talking about. If you want to destroy Nigeria, go and tamper with oil industry; we are finished.

“There have been talks about selling of national assets, such as NLNG, refineries and so on. When I read the stories, I shuddered for the lack of basic understanding of what is on ground. You cannot sell NLNG because it is an incorporated company. Nigeria is only a shareholder in that company. If you talk about selling our shares, it is a different thing. No government can sell NLNG. It is a company where Nigeria and other people have assets,” he said.

Nigeria, according to him, can get out of the recession by leasing oil blocs that have not been developed to the maximum and those that have not been touched. He added that Nigeria could get loans that should be repaid with crude oil over a period of time. He recalled that it was done when Buhari was Head of State in 1984, “and it can also be done now.”

David-West noted that in his letter of appointment as a minister in 1984, the military regime of Gen. Muhammdu Buhari gave him three priority areas, namely, revival of the NLNG, revival of petrochemical and reorganisation of the Nigeria National Petroleum Corporation (NNPC). The mandate, he said, was given to him because the NLNG had failed before Buhari’s regime came on board.

“Why did it fail? Nigeria had spent over $80 billion on wasted NLNG projects before the coming of Buhari. Why was it wasted? Every ministry had representatives on the board of NLNG, which had 25 members. “During Buhari’s time, we changed the concept. What they were doing before that time was, ‘NLNG belongs to us’. You can come and join us to develop it. Nonsense! No businessman will invest in a venture that he is not sure his investments are safe and he will make profits. So, we changed the concept,” he said.

David-West, who noted that he appointed the late boardroom guru, Gamaliel Onosode, as chairman of NLNG in 1984, stated that the regime of Buhari restored the confidence of international investors in the company. Part of the transformation introduced to the company, according to him, was the change in the concept. Nigeria was made a partner and it has bigger shares of 49 percent through NNPC; but the country does not have controlling shares in NLNG. The Shell Petroleum, which was taken as principal technical partner has 25 per cent, and other international companies like the AGIP, Total and so on own 26 percent.

He further said the word ‘sales’ should not come into the question. Instead, he suggested that the country should think about leasing some of the national assets to reliable investors. He sug-gested that the leases should be for a period of 20 years.

“There is difference be- tween freehold and lease- hold. When you sell your property, it is freehold; you will lose your ownership and the buyer will now be

the owner. But in leasehold, you can start the lease for 20 years. At the end of 20 years, it goes back to the owner; you can re-negotiate. You are still the owner of your property. I don’t want the use of the word ‘sell’ at all. Sell is completely out of the question. Nobody sells his crown jewel.

Africa’s richest man, Nigerian businessman Aliko Dangote, has reiterated his plans to buy Premier League club Arsenal.

Dangote, worth $10.9 billion according to the Bloomberg Billionaires Index, had said last year he would make a bid for the top English club but has now said he will wait for his business prospects to improve before putting his plans into fruition.

“Maybe three to four years. The issue is that we have more challenging headwinds. I need to get those out the way first and start having tailwinds. Then I’ll focus on this,” Dangote told Bloomberg Television in New York on Wednesday night.

Bloomberg reports that Dangote, an Arsenal fan, has lost $4.4 billion this year, the fourth most of anyone globally, due mainly to the depreciation of the naira.

An acquisition of the team would make him the first African owner of a team in England’s Premier League.

“It’s not about buying Arsenal and just continuing with business as usual,” he added.

“It’s about buying Arsenal and turning it around. I’ve run a very successful business and I think I can also run a very successful team. Right now, with what we’re facing, over $20 billion of projects, I cannot do both.”

Arsenal’s majority shareholder is currently American billionaire businessman Stan Kroenke who owns 67 per cent of the club..

Dangote Offers FG Solutions That Will Ease Out RECESSION By December, Exchange Naira N250 To A Dollar

News Proof 17.9.16 No comments Edit Post

Aliko Dangote has prescribed ways through which Nigeria can get out of recession before the end of 2016.

In an interview with CNBC Africa, the billionaire said: “The only way for us to get out of this recession is to make sure we move into action quickly; action by diversifying the economy quickly.NL

Here are the details of Dangote’s prescription:

SELL STAKE IN NLNG AND AFRICAN FINANCE COOPERATION

“If I had challenges in my company, I would not hesitate to sell assets, to remain afloat, to get to the better times, because it doesn’t make any sense for me to keep any assets and then suffocate the whole organisation.

“What we need to do now in my own thinking… we have a lot of assets to sell. We can sell part of the joint venture; part of the shares. You know government normally owns 60 percent.

“We can sell in an open tender be it Chinese. We can change the term and make it an operating one, just like what we have in NLNG. We also have another asset I think we don’t really need.

“The African finance corporation; it can fetch them $800million easily. My own suggestion before was that they should even sell 100 percent of NLNG. I don’t think government should be in any business of investing in sectors of LNG.

“A company like that, with earnings of $1.5 billion on the average, they should get anywhere between $12 billion and $15 billion.”

SHORE UP RESERVES WITH NLNG SALE PROCEEDS

“You will not believe that the crisis that we have today, if we have $15 billion, adding it to our $25 billion, that is $40 billion reserves. That will give confidence, confidence will come back, then government will back it up with proper economic policy, where people can see the roadmap.

“Latest by fourth quarter we will be out of recession. It should be a partnership between government and private sector. We have all the answers, Nigeria falling into recession does not really scare me, if we take action.”

NAIRA AT 250 TO THE DOLLAR

The businessman said if the government boosts reserves as suggested, the naira may fall to 250 to the dollar and help the economy.

“Once we can sell assets, and put $15 billion together, you’d be very shocked at how much the dollar will actually drop, you can easily see 250. What is happening today is mere speculation.

“To currency, everybody will speculate, banks will speculate, companies will speculate, individuals will speculate, because if you have money you want to send in from abroad you will keep sending in trickles.

“If you know that CBN has $40 billion in reserves today, if you have $100,000, you might even sell it forward because you know that this rate is going to crash and you must quickly sell it.”

OTHER THINGS WE LEARNT FROM DANGOTE’S INTERVIEW

- India has no oil, yet has over 2 billion tonnes in refining capacity

- Nigeria imports poverty and export jobs

- We do not produce up to five percent of the clothes we wear

- Government should not be in the business of building factories, but just collecting taxes

- China has more than 500 billionaires on the Forbes list and over three million millionaires

- If I have to build a road of 1,000 kilometres in Nigeria, I don’t have to waste years talking about it. I raise money and build it, and hand over to government after 20 to 25 years.

- If not for Dangote Cement, government will have to put down $2.5 billion dollars in 2016 to import cement.

- We need 65 million cubic metres of sand for Dangote refinery.

- Dangote Refinery mechanical completion will finish by 2018, but oil will flow into the refinery by first quarter of 2019.

CHANGE?: Cement Price Soars FROM N1700 To N2300 Within 24hrs; Dangote Others Keep Mum

News Proof 31.8.16 No comments Edit Post

New Telegraph: Cement manufacturers yesterday shocked home seekers and builders by suddenly increasing the price of a 50 kilogramme bag of cement by 35.2 per cent from N1,700 to N2, 300 in 24 hours. As at Monday, the product was still sold at N1,700 per bag.

The major price increase is coming at a time when Nigerians are passing through a difficult economic situation and when everybody believes that the country is self-sufficient in cement production.

Homebuilders who bought some bags of cement on Monday at N1,700 in Lekki, Lagos, could not understand happenings in the building materials market, as they were told by traders that cement price had increased to N2,300.

A survey by New Telegraph further revealed that while the product is sold at N2,300 in Lekki corridor, it is being sold between N2,150 and N2,200 in Ikeja, Mowe and Ibafo axis of Ogun State. When this newspaper made enquiries, a cement retailer in Ibafo, Mrs. Ibidun Oke, said: “That is how we see it.

My supplier just told me yesterday (Monday) that cement price has gone up from the factory. You know we are in change period and many things have happened since this government came on board.”

Efforts to get spokespersons of Cement Manufacturers’ Association of Nigeria (CMAN) and Dangote Cement Plc., Mr. Salako Salako, and Tony Chiejina, respectively to commend on the situation proved abortive as the duo did not pick their calls or respond to text messages sent to them.

Lamenting over the situation, Managing Director of Megamound Investment Limited, developer of Lekki County Homes, Mr. Olumide Osunsina, said he foresees massive job loss and dearth of affordable housing in the sector if the situation persists. He said that he got to know about the price increase on Tuesday morning.

Osunsina said that the increase in cement price was too much, adding that developers may have no option than to limit housing construction activities and also increase house price to stay afloat.

Effects of construction activities, Osunsina said, would lead to sack of construction workers, high cost of housing units and increase homelessness among Nigerians.

Former President of the Nigerian Institute of Building (NIOB), Mr. Chuks Omeife, said that the latest hike in cement price was confusing. “We don’t know what is going on here. We are confused because there is no explanation adduced for it,” he said.

However, he blamed the situation on foreign exchange and monopolistic nature of cement manufacturers in Nigeria. If the situation persists, Omeife stated that housing projects are going to be delayed with increase in cost of delivering affordable units.

He said: “If the price increase in cement remains for a long time, it is going to compound the problems of affordable housing in the country because it will trickle down to block manufacturers and artisans.”

Cement is a major component used for building production process, especially in Nigeria. Dangote Cement Plc. and Larfarge Africa are major manufacturers of the product in Nigeria.

The major issue raised recently by cement manufacturers was about lack of gas supply owing to the blowing up of oil and gas pipelines by militants in the Niger Delta region.

Nigeria is currently facing one of its worst financial crisis in decades, coupled with inflation rising, the economy weakening and production of oil, which provides the bulk of export earnings, down since last February as militants attack pipelines.

Economic output will probably shrink 1.8 per cent this year, the first contraction in more than two decades, the International Monetary Fund (IMF) said recently.

Besides, pressure is also building, with bank loan books – nearly half of them in dollars – hammered by a shrinking economy, a plunging currency and acute foreign exchange shortages in Africa’s biggest oil producing nation following the slump in oil prices.

As at yesterday, the naira had slumped further at the parallel market to N418 per dollar, while it traded on the interbank at N305. These developments have raised the cost of living in the country without any corresponding increase in wages of citizens.

The continent’s richest man; Aliko Dangote has averred that Nigeria remains the number one economy in Africa despite the widely reported story yesterday that South Africa had overtaken Nigeria as Africa’s biggest economy.

Speaking today at the Lagos Chamber of Commerce and Industry 2016 presidential policy dialogue session, the president of the Dangote Group spoke on Thursday argued that the problem with the economy did not start with the present administration.

After over two years in the position, Nigeria lost the enviable position to South Africa owing to the appreciation of the rand, South Africa’s currency, and the devaluation of the Nigerian naira following the introduction of a flexible foreign exchange rate regime.

However, Dangote was resolute that Nigeria’s place in the African economy has not yet been overtaken.

How I Increase My Blokos Size & Stopped Premature Ejaculation Issues That Scattered My Relationship For 2years.. Click HERE for Details

Naira's Fall Falls Dangote, Crumbles Off World Top 100 Rich List

News Proof 25.7.16 No comments Edit Post

President of Dangote group, Aliko Dangote, has dropped off the list of the 100 richest people in the world.

Ranked richest African/black person in the world, Dangote was the 51st richest man in the world as at March 2016, but has dropped to 101 as at the start of business on Monday.The drop is reported to be as a result of the naira crash which has placed a huge dent on his business ventures.

Dangote, who owns the second largest sugar-refinery in the world, remains richer than Donald Trump, American billionaire presidential candidate, and Oprah Winfrey, US TV personality, who dubs as the second richest black woman in the world.

Dangote is now worth $11.1 billion, while Trump and Oprah are estimated at $4.5 billion and $3.1 billion, respectively.

The fall in the naira, as against the dollar, from about 198 to about 300, has eroded about a quarter of Dangote’s wealth, as he commits to investing heavily in Africa’s largest economy, Nigeria.

At the launch of the new foreign exchange regime on June 23, 2016, Dangote fell from 46 on the world billionaire list to 71, and has continued in that manner with the naira plunge.

According to Bloomberg billionaires, Dangote, who was worth $15.4 billion (N3.05 trillion) in March, is now worth $11.1 billion (N3.3 trillion) —richer in naira, but poorer in dollars.

The launch of Dangote refinery, the biggest greenfield refinery in the world, billed for 2018/2019 is expected to propel him into top 20 by 2019.

Dangote Cement, one of Dangote’s major investments in Nigeria, is the biggest company on the Nigerian Stock Exchange, by market capitalisation, and the biggest cement producer in sub-saharan Africa.

According to Fortune 500,the company however missed out of the 100 biggest companies in the world

Subscribe to:

Posts (Atom)