Showing posts with label CBN. Show all posts

Showing posts with label CBN. Show all posts

UNBELIEVABLE: Fresh N30tr FOREX FRAUD Exposed, See List Of Banks Indicted

News Proof 13.4.17 No comments Edit Post

Punch Newspaper - The Senate has begun an investigation into alleged foreign exchange racketeering by commercial banks and importers.

The upper chamber of the National Assembly alleged that Nigeria had lost over N30tn to the alleged forex diversion between 2006 and 2017.

The Senate Committee on Customs, Excise and Tariff, on Wednesday, met with commercial banks in the country, asking them to furnish it with evidence that forex, released by the Central Bank of Nigeria to the importers through the banks, was utilised as documented.

The panel, which provided documents of transactions within the years under review to representatives of the banks, asked the financial institutions to furnish it with the evidence of proper utilisation of the forex releases within three weeks.

The Chairman of the committee, Senator Hope Uzodinma, while briefing journalists after the meeting, said the Senate mandated the panel to “investigate and identify areas of revenue leakages in the entire import and export circle.”

He alleged that “all” banks in the country were suspected to have been responsible for the revenue loss.

The lawmaker added that the matter would be referred to the Economic and Financial Crimes Commission and security agencies at a certain level of the probe.

“In the course of the investigation, issues that border on financial crimes will be sent to the EFCC; the ones that are internal security issues will be sent to the various agencies. Government is one, whether you are in the executive or the National Assembly,” he said.

Uzodinma stated that the Governor of the Central Bank of Nigeria, Mr. Godwin Emefiele; Minister of Finance, Mrs. Kemi Adeosun; and Minister of Budget and National Planning, Senator Udo Udoma, would also be invited by the committee.

Uzodinma said, “The committee started investigation and took time to enter into the import and export value share and we have been able to identify, supposedly, areas of leakages and malpractices ranging from unutilised, abandoned and partially utilised ‘Form M’; abandoned assessment of Customs duties and foreign exchange allocation manipulation.

“We have been able to also go into the database of the operating system of the Nigeria Customs Service, otherwise called ASYCUDA, and we identified Form M by Form M, import by import, vessel by vessel, liabilities of importers and commercial banks that have yet to be handled.

“We are talking about monies in a region of over N30tn and we have been able to give all this information to the commercial banks, who purchased the foreign exchange on behalf of the importers, to go home and come back with evidence of utilisation of the forex, failure which they will be compelled to refund those foreign currencies they bought from the Central Bank of Nigeria or interbank, supposedly to be used for imports.”

Uzodinma added, “What we are saying in essence is that the amount of foreign exchange the government is giving out to commercial banks and importers for the purpose of importation is not fully or not utilised as agreed.

“In essence, it is making foreign exchange scarce in the market; making the foreign exchange that the government is conceding to importers, not to be directed into activities of importation.

“We don’t see this as a healthy development because, in the process, so many companies are now ‘round tripping’, sending monies they don’t deserve out of this country without due process. This is what we are out to resolve.”

The Senator pointed out that after the conclusion of the probe by the panel, “I can tell you that the exchange rate will come down drastically. Only genuine importers will then enjoy government’s forex allocation.”

When asked if the banks were accomplices in the forex racketeering, Uzodinma responded, “There is no bank that is exempted; all the banks are involved – both the banks that are dead and the ones living.

“The ones that are no more operating were acquired by some banks. So, the activities of those that are no longer in operation, we have been able to tie them (activities) to those that acquired them (banks) as part of the liabilities.”

Uzodinma was also asked why the panel was focusing mainly on banks.

He said, “The foreign exchange utilisation manual prepared by the Central Bank of Nigeria as a regulation guiding import and export has entrusted with commercial banks this quantum of responsibilities because they purchase this money (forex) on behalf of the importers. Under the agency statute, once you are acting on behalf of somebody, the offence or the inaction of that person is your inaction.

When asked about the role, of the ministers and the Nigerian Shippers Council in the scam, Uzodinma said the panel met with shipping companies on Tuesday, where “the infractions caused by the shipping companies themselves” were identified.

He added that the council, as the regulatory body, had been notified and was billed to respond to the panel’s queries in two weeks.

...And Again The Naira Resumes Fall Again As External Reserve Drop Significantly ...See New Exchange Rate

News Proof 1.4.17 No comments Edit Post

The Nigeria's naira yesterday suffered a huge loss at the black market as the country’s external reserves fell to a two-week low after the Central Bank of Nigeria pledged to step up dollar sales.

This came just as the CBN said it would announce a new exchange rate for Bureau De Change Operators next week, Reuters reported.

The central bank had on Tuesday set a rate of N362/dollar for the BDC operators to sell the greenback to customers, an 11 per cent rise over the 399 it set in January.

The CBN has been selling the dollars on the official market in order to narrow the spread with the black market rate, which was quoted at a record low of N520 per dollar a month ago.

On Friday, the black market naira rate, which has firmed 17 per cent since last month due to central bank dollar sales on the official market aimed at narrowing the spread, eased by 1.8 per cent to 390/dollar, Thomson Reuters data showed.

The naira held its level at 306.35 to the dollar after the central bank sold $1.5m on the spot market.

The CBN had on Thursday said it would increase the amount it was offering to the BDCs to $10,000 per member from $8,000, but would announce a new rate on April 3.

Traders said the new rate announcement had created uncertainty and caused the naira to trade weaker on the black market.

But dollar buffers have started to decline. Traders estimate that the bank has sold more than $1bn in currency forwards since last month to boost liquidity.

The external reserves, which have risen by 16.1 per cent since the start of the year, stood at $30.29bn by March 29, but are still far off their peak of $64bn, hit in August 2008, the CBN data showed.

The International Monetary Fund on Thursday urged the Federal Government to lift the remaining foreign exchange restrictions and scrap the system of multiple exchange rates in order to revive the economy.

Economic and financial experts said they were not sure if the CBN would continue to intervene in the market, especially as the price of oil continued to decline slightly in recent times.

Some analysts believe the central bank may not cut further the N360/dollar rate set for the sale of the greenback for invisibles by commercial banks.

2 CBN Directors Behind Recent Naira Crashes ARRESTED, Incriminating Items Seized

News Proof 30.3.17 No comments Edit Post

Two directors of the Nigerian Apex bank, the Central Bank of Nigeria have been arrested by the Economic and Financial Crime Commission, EFCC in connection to the recent free falls of Naira currency against the dollars and other international currencies

Multiple impeccable sources revealed the director are still in the custody of the EFCC, Punch Newspaper reports this morning

An investigation into the CBN officials activities sent shockwaves round the apex bank, News Punch learned

The detective said the houses of the directors had been searched while incriminating evidence had been recovered.

According to Punch Newspaper, a source at the EFCC, who wished to remain anonymous said, “We have arrested two directors of the CBN in connection with forex manipulation. We believe that it was the activities of these individuals that contributed to the dollar scarcity and the weakening of the naira.

“Ironically, immediately we started investigating these chaps a month ago, the CBN reeled out a new forex policy which sought to flood the market with excess dollar and strengthen the naira.

“Already, we have searched their houses and recovered some sensitive documents. We have reason to believe that they may not have acted alone. We expect to make more discoveries as investigations continue.”

When contacted, the Acting Director, Corporate Communications Department, CBN, Mr. Isaac Okoroafor, said no director of the apex bank had been arrested by the EFCC.

He said, “This is not true. No director of the bank (CBN) has been arrested by the EFCC. The current activities of the CBN in the forex market is a result of months of study, monitoring and planning to tackle the activities of black marketers.

“We are succeeding and Nigerians are happy with us. No amount of false rumours and concoctions to ridicule and sabotage the success we have achieved will make us lose our focus at this time.”

BREAKING: CBN Just Give New Rate To Sell The Naira Against $1, You'll Be Shocked

News Proof 27.3.17 No comments Edit Post

The Central Bank of Nigeria, CBN, on Monday directed all deposit money banks to immediately commence the sale of foreign exchange to their customers at N360 to the dollar.

In a statement by the apex bank spokesperson, Isaac Okoroafor, all customers requesting forex for their basic transport allowance and personal transport allowance, tuition and medical fees, would henceforth get it at an exchange rate not more than N360 to 1 dollar.

The terse statement reads, “The CBN to sell forex to banks at N357/$1, while banks will sell to their customers at N360/$1 for invisibles (BTA, medicals, fees, etc),” the apex bank said on Monday.

“CBN directs banks to post new rates in the banking halls of their branches immediately. CBN examiners to visit banks to ensure the new rates are implemented.

“CBN prohibits banks from selling forex funds meant for invisibles to BDCs”

The apex bank said it would sell to commercial banks at N357 per dollar and banks are to post the new rates in their banking halls of their branches immediately.

What We Actually Did That's Making Naira Appreciates Against The Dollar - CBN

News Proof 3.3.17 No comments Edit Post

The Central Bank of Nigeria (CBN) said yesterday that the currency’s appreciation against others was the result of its market monitoring and intervention.

Its spokesman Isaac Okorafor refuted the claim that illegal sale of foreign currencies at ridiculous rates was responsible for the change in Forex policy.

Okorafor, who spoke in Sokoto, also explained that the appreciation of the Naira was in no way connected to the allegations of illegal sale of foreign currencies.

“I want to state categorically that there is no relationship whatsoever between the allegations that dollar was being sold at 61 kobo and the current appreciation of the Naira.

“What led to the appreciation of the Naira was that the CBN did an intelligence on the market and realised that what was driving the demand on the Bureau De Change (BDCs) and parallel market was speculation.

“We reasoned that since there is a lot of pressure on the two segments from people seeking to buy foreign currencies for BTA, tuition and medicals, that if we successfully addressed that, the pressure will come down.

“Also, before now, the level of our reserves was not enough to make us comfortable enough to really do the kind of intervention that is required.

“We decided to do so now because we are a bit more comfortable with our level of reserve,” he said.

Okorafor said since the new Forex policy, the CBN had intervened with about 591 million dollars in the market, which had led to Naira gaining strength.

“Let me also state as proof that when we placed 500 million dollars in the market, only 370 million dollars was taken.

“That tells you that the real demand is 370 million dollars. When we placed 230 million dollars in the market, only 221 million dollars was taken.

“Anybody who has gone foul of the law and the security agencies have caught up with him, should go and face his or her case and stop causing confusion among participants in the market,” he said.

Watch CBN Forex Fraud Video By Arrested Gbadamosi That Earned Emefiele FG's Query .. You'll Cry For Nigeria

News Proof 2.3.17 10 comments Edit Post

A Peoples Democratic Party (PDP) chieftain, Babatunde Gbadamosi has said he was released by the Department of State Services (DSS) without preconditions.

Gbadamosi, who was arrested last week,regained his freedom on Thursday.

“I was freed without preconditions. They just allowed me to go without filing charges,” he told Premium Times.

He also expressed his appreciation to those who spoke out after he was arrested.

“I appreciate the efforts of Nigerians and the sacrifice they made to secure my freedom.

“I will brief them extensively about what happened after briefing with my lawyers”, he added.

Watch The Video:

Before his release today, While Nigerians are still speculating the actual reason behind the sudden appreciation of the Naira over major International currencies since February 20, 2017 and Central Bank of Nigeria (CBN) sudden change of policy, Mr Babatunde Gbadamosi, a Lagos Businessman and former governorship candidate, who exposed in details the monumental organized foreign currency fraud by the Buhari government and officials of CBN was arrested and still detained by the Department of Security Services (DSS) since February 22, 2017.

Before his release today, While Nigerians are still speculating the actual reason behind the sudden appreciation of the Naira over major International currencies since February 20, 2017 and Central Bank of Nigeria (CBN) sudden change of policy, Mr Babatunde Gbadamosi, a Lagos Businessman and former governorship candidate, who exposed in details the monumental organized foreign currency fraud by the Buhari government and officials of CBN was arrested and still detained by the Department of Security Services (DSS) since February 22, 2017.

In a social media video which went viral, Mr Gbadamosi frowned at the shabby practices where those that genuinely need foreign currencies for Business are not provided with any, while the President’s allies and the cronies of CBN big-wigs are receiving them at ridiculously low rates of N3/$1.

Every effort to secure Mr Gbadamosi’s release has proved abortive. The DSS has ensured that no one visits or see the incarcerated voice of the Nigerian opposition in the secret detention center he was dumped six days ago and sources close to Hope For Nigeria within the secret police headquarters in Abuja are claiming that Gbadamosi was accused of blackmailing the Central Bank of Nigeria and the Government by releasing this classified information about forex sales.

Regrettably, while Mr Babatunde Gbadamosi is languishing in DSS secret detention center for saving Nigeria from the forex mafia, Nigerians are giving the glory to the acting President Osibanjo who raised no finger in the new development where the CBN suspended forex sales to cronies and allies of President Buhari and sudden revert to the policies of the former President Goodluck Jonathan, where the Naira is protected with our external reserve.

Re-echoing the concern of Nigerians including that of the former CBN governor and the Emir of Kano, Sanusi Lamido who revealed the operation of over 20 different foreign exchange rates by the CBN and some Nigerians making billions of Naira daily from their gardens trading dollar they bought at an alarming low rates, Mr Gbadamosi demanded that these sharp practices should stop in other for the country to survive the self-induced recession.

Gbadamosi quoting various media sources in the video stated that the CBN was selling forex to some close allies of President Muhammadu Buhari for as low as N3 to $1 through what is called Bills of Collection. People were given Dollars with cold claims that their Form M was filled and submitted like 35 years ago but forex was not released. They cartel only has to claim that they made their importation in 1985 but forex was not released to you despite submitting duly completed Form M.

With all documents perfected, the forex will then be released at the prevailing rate in 1985. They will get $3 million at N5/ $1 and selling to end users at say N480/ $1. The said customer will be making about N1.425billion in one transaction. He listed transactions by some individuals that got $4,327 at the rate of N23.34 to $1 through “credit card payment” for “invisible” purpose and under “invisible sector”.

A bank also got $3,589.11 at the rate of N3.19 to $1 also for “invisible” purposes and under “invisible” sector. There was a transaction involving sales of $66.72 at the rate of N0.62 to $1. There was also a sale of $5.56 to a company at the rate of N0.61 also for “invisible” purposes. A particular transaction also involved the sale of $570.8 at the rate N3.17.

In contrast, there was a company, who purchased $1,462,480.83 at the rate of N425 to $1. The document shows that individuals and companies got foreign exchange for purposes ranging from importation, PTA, school fees, “invisible”, family maintenance allowances, mortgage payments and medical travel among others.

This video leads the Attorney General of the Federation and Minister of Justice, Mr. Abubakar Malami (SAN), to query the CBN Governor, Mr. Godwin Emefiele, demanding “prompt response” to the allegations of corruption in the CBN’s foreign exchange allocation and transactions. Multiple Petitions against the CBN indicated how some companies and individuals got a foreign exchange in US dollars at the rates as low as low as N0.61 to $1 while others got it in rates that were as high as N470 to $1.

Malami, in the letter, dated February 6, 2017, and with reference number, HAGF/CBN/2017/VOL.1/1, asked Emefiele to respond to the allegations “to enable us to advise the Presidency and take appropriate measures.” Titled ‘allegations of racketeering in the Central Bank of Nigeria; disparity in allocation of foreign exchange’, and addressed to Emefiele, the letter was delivered to the CBN governor’s office on Monday.

The allegations in the attorney general’s letter to Emefiele includes:-

1. alleged corruption in the apex bank’s “foreign exchange allocation transactions.

2. Questionable policy in CBN’s allocation and sale of foreign currency to Nigerians.

3. Arbitrary allotment of different exchange rates for same purposes. 4. Allocation of conflicting foreign exchange rates.

The DSS has not charged Mr. Gbadamosi after six days of arrest and they denied him medical attention, family visits and rejected the request for his lawyers to see him or be informed of the reason for his arrest.

It is shocking to note that Nigerians are enjoying the appreciation of the Naira over major currencies and praising the CBN and the government that oversees the foreign currency fraud that almost crippled the Nigerian economy while the man who sacrificed neck for us, is under chain and locked up in secret detention center.

Source: Nigerian Newspaper

FOREX: Naira In Shocking N85 Gain Against The Dollar As FG's New Policy Yielding Result ..See New Exchange Rate

News Proof 28.2.17 No comments Edit Post

In less than one week, the naira has gained over N85 against the dollar – thanks to the increased liquidity in the foreign exchange market.

The currency exchanged for N430 to the greenback yesterday at the parallel market. It was N460 to the dollar at the weekend.

The Central Bank of Nigeria (CBN) yesterday released $100million into the wholesale forwards segment of the market and $80million into the banks specifically for the settlement of dollar demand for school fees, medicals and Personal Travel Allowance (PTA), among others.

CBN spokesman Isaac Okorafor, in a release, said that its commitment to providing enough forex for legitimate business remained unshaken, pointing out that it would do all that is required to ensure the steady supply of forex to the market.

Naira’s appreciation has raised hopes that the naira/dollar exchange rate may well be on a permanent journey to the N300 to the dollar predicted by some analysts in the past.

The apex bank last week rekindled the forex market by releasing $500million to be accessed through the Deposit Money Banks to fund school fees, Personal travel Allowance and medical bills.

The CBN had maintained that much of the dollar demand had been a bubble created by speculators and hoarders of the greenback, warning market players and keepers of dollars to make hay and sell their holdings to avoid heavy losses.

...And Again, Our Naira Gains More Strength Against The Dollar ...The New Rate'll Amaze You

News Proof 27.2.17 No comments Edit Post

The naira rose to 445 against the United States dollar at the parallel market on Sunday, one week after the Central Bank of Nigeria introduced a new policy measure aimed at boosting foreign exchange supply in the market.

The local currency, which had tumbled to 520/dollar last Monday, closed at 450 on Friday.

The CBN had last Monday commenced the implementation of the reformed forex policy with a promise to sell $1m weekly to each of the 21 commercial banks in the country.

Following the announcement of the new forex policy measure by the CBN on Monday, the naira commenced a gradual reversal of its previous losses, closing at 512/dollar on Tuesday.

It recorded further gain on Wednesday and Thursday, closing at 505/dollar and 495/dollar, respectively.

Foreign exchange traders said the CBN had intervened on the official market in recent days.

Economic and financial experts told our correspondent on Sunday that the naira would record further gain this week but not as big as last week’s.

“There is always a restriction point beyond which the exchange cannot cross except there is a huge forex inflow to breach that ceiling,” a currency analyst at Ecobank Nigeria, Mr. Kunle Ezun, said.

“The naira will gain further but it won’t be like last week’s own.”

The Managing Director, Financial Derivatives Company Limited, Mr. Bismarck Rewane, commended the CBN for the policy reform and wondered why the regulator had delayed such measure for months.

Rewane said, “With less than $600m supply into the spot market, the naira has gained 13 per cent of its value to N460/$ on Friday. Can you imagine what would have happened if the spot market was adequately funded in a transparent manner for nine months ago, rather than the opaque forward transactions.

“Maybe we could have had a soft landing rather than a race to the bottom. This move by the CBN is a good one in the right direction provided the dollar supply is sustained.

“We expect the CBN to commit itself to a regular and predictable supply of dollars to the forex spot market in March. There will be a rapid convergence of rates and a gradual end to multiple exchange rates and forex abuse.”

The Managing Director of Cowry Asset Management Limited, Mr. Johnson Chukwu, also believe the naira will rise further this week.

Chukwu said, “Confidence is beginning to return to the market. The naira will gain further but there may be resistance around N400/dollar because the CBN sells to BDCs currency at 381/dollar.

“The CBN needs to watch and sustain this intervention for weeks. They need to work with the fiscal authority to get the $2.3bn loan from World Bank and China released on time.”

Chukwu, Ezun and other experts advised the CBN to re-admit the banned 41 items into its official forex window.

According to them, there is the need to discourage end-users from going to the parallel market to source for forex.

BREAKING: CBN Announces New Foreign Exchange Policy Regime; See New Exchange Rate

News Proof 20.2.17 No comments Edit Post

The Central Bank of Nigeria, CBN, has released a new foreign exchange policy in the country with immediate effect.

The new policy is sequel to last Thursday’s directive by the National Economic Council, NEC, for immediate review to stem the widening gap between the inter-bank foreign exchange and parallel market rates.

The CBN said in order to ease the difficulties encountered by Nigerians in obtaining funds for foreign exchange transactions, it would henceforth be providing direct additional funding to banks to meet the needs of Nigerians for personal and business travel, medical needs, and school fees, effective immediately.

In this regard, the Central Bank of Nigeria, CBN has mandated banks to open Forex retail office at all major airports to ease transactions for intending travellers.

The apex bank said in its new policy action on the Foreign Exchange Market today in Abuja further said “In order to further ease the burden of travellers and ensure that transactions are settled at much more competitive exchange rates, the CBN hereby directs all banks to open FX retail outlets at major airports as soon as logistics permit.”

The federal government has given 11 reasons why it believes that the economy is on its way out of recession that has rocked the nation for almost a year.

The government described the reasons as proofs in a report contained in Issue 23 of Aso Villa’s Newsletter titled: ‘Government at Work’

The reasons stated in the report are summarized as follows:

1. Over-Subscription of FG’s Eurobond.

According to the report, government targeted $1 billion but got $7.8 billion in one week, which has confirmed the confidence level of the international investment community in Nigeria’s economic reform agenda.

2. Growth in non-oil sector of the economy.

The report states that agriculture grew by 4.54%, crop production is at nearly 5% (its highest since the first quarter of 2014) and the solid mineral sector averaged about 7% during the third quarter of 2016.

3. The Anchor Borrowers Programme (ABP) of the Central Bank of Nigeria.

The programme substantially raised local rice production in 2016 (yields improved from two tonnes per hectare to as much as seven tonnes per hectare, in some states) and produced a model agricultural collaboration between Lagos and Kebbi states.

4. The Fertilizer Intervention Project.

According to the report, the project involves a partnership between the federal government and the government of Morocco, for the supply of phosphate. It is on course to significantly raise local production, and bring the retail price of fertilizer down by about 30 percent.

5. Take-off of the newly established Development Bank of Nigeria (DBN).

With an initial funding of US$1.3bn (provided by the World Bank, German Development Bank, the African Development Bank and Agence Française de Development), medium and long-term loans to will be available for Micro, Small, Medium-scale Enterprises (MSME) for job creation.

6. A new Social Housing Programme.

The programme is kicking off in 2017. The ‘Family Homes Fund’ will take off with a 100 billion naira provision in the 2017 Budget. (The rest of the funding will come from the private sector).

7. More than N800 billion released for capital expenditure in the 2016 budget.

The report claimed that this is the largest ever capital spending within a single budget year in the history of Nigeria. These monies have enabled the resumption of work on several stalled projects – road, rail and power projects – across the country.

8. Implementation of the Social Investment and Empowerment Programme (SIP).

All the four components of the SIP, the report noted, have now taken off. It described the SIP as the largest and most ambitious social safety net programme in the history of Nigeria, with more than 1 million beneficiaries so far: – 200,000 N-Power beneficiaries, 23,400 Government Enterprise and Empowerment (GEEP) Scheme beneficiaries, 1,000,000 Homegrown School Feeding Programme (HGSFP) beneficiaries, and ongoing Conditional Cash Transfer (CCT) payments across nine pilot states.

It said:

9. Strategic Engagements with OPEC and in the Niger Delta

According the report, the engagements have played an important part in raising expected oil revenues. Already, Nigeria’s External Reserves have grown by more than $4 billion in the last three months.

10. Collaboration with China.

President Buhari’s April 2016 visit to China, has unlocked billion of dollars in infrastructure funding. Construction will begin on the first product of that collaboration, a 150km/hour rail line between Lagos and Ibadan, in Q1 2017.

11 The National Economic Recovery and Growth Plan (NERGP).

The Federal Government’s medium-term Economic Plan, is due for launch in February 2017, and will chart a course for the Nigerian economy over the next four years (2017 – 2020),” it stated

EXPOSED: How FG, Banks ILLEGALLY Collecting N50 Stamp Duty SECRETLY From Saving Accounts Of All Nigerians

News Proof 3.1.17 No comments Edit Post

In a shady and illegal manner, to boost government’s revenue, the central bank of Nigeria has instructed commercial banks across the country to extend the deduction of N50 stamp duty to savings account transactions.

The apex bank had previously exempted savings accounts through a circular issued on January 15, 2016. “For the avoidance of doubt, the following receipts are, however, exempted from the imposition of stamp duties: payment deposits or transfers by self to self, whether inter or intra bank; and any form of withdrawals/transfers from savings accounts.”

While it was not clear when the stamp duty collection was extended to savings accounts, some bankers said the only exemption now was deposits made by the owners of savings accounts.”

This means every third party deposit into a savings account with a value of at least N1,000, will be automatically charged N50 stamp duty fee, which the bank has a responsibility to transfer to the NIPOST Stamp Duty Account domiciled with CBN.

The circular reads “With immediate effect, all DMBs and other financial institutions shall commence the charging of N50 per eligible transaction in accordance with the provisions of the Stamp Duties Act and the Federal Government’s Financial Regulations 2009; that is, all receipts given by any bank or other financial institution in acknowledgement of services rendered in respect of electronic transfers and teller deposits from N1,000 and above.”

Meanwhile, the Lagos division of the Appeal had ruled that imposing a stamp duty on any electronic transaction was illegal.

The ruling on an appeal filed by Standard Chartered Bank against Kasmal International Services Limited and 22 others, Justice Ibrahim Saulawa and four other justices of the Court of Appeal, Lagos Judicial Division, held that the Stamp Duties Act, 2004 did not impose a duty on the DMBs to deduct N50 on bank deposits.

Meanwhile, the Lagos division of the Appeal had ruled that imposing a stamp duty on any electronic transaction was illegal.

The ruling on an appeal filed by Standard Chartered Bank against Kasmal International Services Limited and 22 others, Justice Ibrahim Saulawa and four other justices of the Court of Appeal, Lagos Judicial Division, held that the Stamp Duties Act, 2004 did not impose a duty on the DMBs to deduct N50 on bank deposits.

RECESSION: N100, N5, N10, N20, N50 Denominations SCARCITY Hit Nigerian Banks

News Proof 30.12.16 No comments Edit Post

Nigeria’s prevailing economic recession has forced the Central Bank of Nigeria (CBN) to suspend printing of small naira denominations for about a year, leading to the scarcity of the notes in the economy, sources at the apex bank have disclosed.

The News Agency of Nigeria (NAN), citing sources at the CBN, reports that for a year now, the apex bank did not award contract for the printing of the notes such as N5, N10, N20 and N50 usually done abroad.

According to NAN, the recently printed notes in circulation, including N200, N500 and N1,000, were produced by the Nigeria Security Printing and Minting (NSPM) Plc.

Sources attribute the high cost of printing banknotes as the reason the apex bank did not award contracts for their production.

“The cost of printing N50 is almost the same as N1,000 but printing small denominations costs more than the value and with the present economic situation, it makes sense to print higher notes, which can be done locally by NSPM,” a source said.

Confirming the scarcity of the small naira denominations in the country, a worker at the First Bank Plc said that there were hardly smaller currency notes to give to customers throughout the 2016 festive seasons.

“We usually request for cash from the CBN through our Cash Management Centre, but recently, we have not been able to get mints of N100 and below. We had N50 at one point but it wasn’t in the quantity we are used to getting.

“We have been telling our customers who call to request for mints that the smallest note they can get is N200,” the bank employee, who pleaded anonimity said.

But the CBN has denied the allegation that it had not contracted the printing of smaller denomination currencies since 2015.

The CBN Acting Director, Corporate Communications, Mr. Isaac Okorafor, dismissed reports of scarcity of smaller denominations in the market.

He said people are complaining because the CBN did not make provision for mints to be supplied in smaller denominations during the festive season.

“You see, people are fond of abusing these denominations by spraying them to be stepped on during weddings and other ceremonies. The abuse is even worse during the festive season, so we decided to make scarce the denominations. But it’s not that we have not been printing them. Yes, we haven’t printed abroad but we also print locally, which we have been doing,” he said.

3 Reasons Why No Country'll Borrow Buhari The $30b - Emir Sanusi BOMBS FG's Archaic Economic Policies

News Proof 2.12.16 No comments Edit Post

The Emir of Kano, Sanusi Lamido Sanusi has enumerated three reasons why no country or any financial institution will borrow Nigeria the $30 billion President Muhammadu Buhari is seeking it approval from the Senate.

Sanusi, strongly kicking against the move pointed out that with Nigerian current ambiguous 5 foreign exchange rates, bombings of oil facilities in the Niger Delta and poor foreign reserve will get the lending anywhere in the world.

The former Central Bank of Nigeria (CBN) Governor said even if the Senate gave its ascent to the loan, no country or global financial institution would be willing to grant such huge amount.

Sanusi, during a policy dialogue forum organised by the Savannah Centre for Diplomacy, Democracy and Development (SCDDD), in Abuja disclosed that for a nation that has five exchange rates, it would be difficult for such request to scale through.

Sanusi emphasised that oil cannot help the nation out of the current economic situation and that it would “never make Nigeria rich.”

His words: ”I can tell you for free, if the Senate today approves that we can borrow $30 billion, honestly, no one will lend us. It should be approved and I will like to see how you will go to the international market with an economy that has five exchange rates.

“There is one rate for petroleum marketers, there is inter-bank rate, there is another for money market operators such as western union, money gram, there is bureau de change rate and there is a special rate you get when you call the CBN for a transaction.

“So, who will borrow you when they don’t know your exact reserve and exchange rate. I want to see who will borrow you money when the Niger Delta bombing of oil is there when the main source of the loan repayment is oil.”

He noted that the country’s population continued to grow to over 40 million people since 2015, yet government found it hard to increase capital expenditure.

“We trust China too much. We need to be very careful. They are killing our textile and other industries and yet selling to us,” he added.

He said the country in the past 15 years had been borrowing money to pay salaries, fuel subsidy and there are possibilities for the nation to keep borrowing in the next 15 years, as those borrowed were not channeled into health, power or infrastructural development.

“The Senate should support tax incentives and other benefits to encourage private sectors,” he added.

In his remark, former Anambra State Governor, Peter Obi called for drastic reduction in cost of governance.

SHOCKER: How CBN Facilitated Jonathan's Aide Bought N650m Abuja Mansion From Fraud Proceed

News Proof 19.11.16 No comments Edit Post

A Federal High Court in Abuja heard Friday how former Principal Secretary to ex-President Goodluck Jonathan facilitated the purchase of a property in Maitama, Abuja with N650million paid from the account of the Office of the National Security Adviser (ONSA) domiciled in the Central Bank of Nigeria (CBN).

Samuel Babatunji Adeniyi and Kabiru Yaro, who testified as 3rd and 4th prosecution witnesses in the trial of Jonathan’s cousin, Robert Azibaola, his wife, Stella and their company, One Plus Holdings Limited, gave details of how the property located at 15 Rio Negro Street was bought.

Yaro and Adeniyi gave the name of the ex-Jonathan’s aide as Ambassador Hassan Tukur.

They told the court that they did not know the defendants in person and have never related with them until they met them in court Friday. Both witnesses were led in evidence by prosecution lawyer, Sylvanus Tahir.

Yaro , who described Tukur as his childhood friend, said the property is located next to Jonathan’s house.

“Sometime in October 2014, Nuuman Barau Dambatta, approached me that he had some debts in the bank and he wanted sell his two properties, one in Kano and one in Maitama, Abuja.

“I told him I was not interested and he requested that the house in Maitama was a neighbour to former President Goodluck Jonathan.

“He asked me if I could speak to Ambassador Tukur to see if he (Tukur) could buy the property. I called the ambassador and I told him that Barau was interested in selling the property and if he could assist.

“I arranged, and Nuuman went to meet the ambassador (Tukur). Later Nuuman called me and asked for the Certificate of Occupancy and gave it to the ambassador.

“Later Nuuman called me and said a valuation had been made on the property and that the valuation on the property was N650m, which the ambassador said he had got a buyer for, but he didn’t tell us who it was.

“Later sometime in December 2014, the money was paid to Alhaji Nuuman Baraua’s estate agent.

“Nuuman called me to say the payment he received came from the Central Bank of Nigeria, and I told him he sound call and ask the ambassador (Tukur) why the money came from there.

“I said I didn’t know and that whatever name to he (Nuuman) saw was the one who had bought the property. After he signed the document, he gave them to me to take back to Ambassador Hassan Tukur.

“That day he asked me to sign the original C of O. I collected it from him and signed it. From that time, the handing over is between him and the property buyers and I don’t know what else transpired until this matter came up,” Yaro said.

Adeniyi, an estate surveyor and valuer, said he signed the sale documents, prepared in the name of One Plus Holdings, as a witness of the property seller.

“Later our client (Nuuman) now told me that it’s like that and they (Tukur and his agents) are serious now. And he asked me to text our company’s account number to him.

“Of course, I texted the account number details to him, I mean our account to him, I mean our account number at Wema Bank.

“Suddenly on December 9, 2014, I got an alert of N650m from Wema Bank which tallied with the figure he had agreed with the prospective buyers.

“Immediately I contacted him. I forwarded the text of the bank alert him that same night of December 9, 2014.

“The details of the source of payment was ‘NEFT ONSA’ was the narration of the test that I got on the alert which I forwarded to our client.”

He said the sale document was later prepared by a legal firm, M.B. Shehu & Co. which he said he signed as a witness.

“The assignor is Alhaji Nuuman Barau Dambatta and the buyer was One Plus Holding.”

Defence lawyer, Chris Uche (SAN), while cross-examining Adeniyi, tendered his (Adeniyi’s) statement which he made to the EFCC.

Although Tahir objected to the admission of the statement, Justice Nnamdi Dimgba overruled his objection to admit the statement.

Justice Dimgba later adjourned to January 30 for continuation of trial.

DSS Raids Parallel Market, Arrests Dealers Selling Dollar Above N400

News Proof 10.11.16 No comments Edit Post

TheCable - The Department of State Services (DSS) on Thursday raided the foreign exchange parallel market in Lagos and Abuja, arresting dealers who were selling the dollar above N400.

A dealer, who confided in TheCable, said some of his colleagues were among those arrested.

“The DSS visited the market and arrested some of my colleagues, but I was saved because I didn’t have dollar to sell at the time,” the middle-aged dealer said.

“They want us to buy at N390, and sell at N400. That cannot work for now; there is no dollar in the market.”

Ibrahim Baba, another dealer, who spoke to TheCable from Abuja, said DSS and police visited the markets, but made no arrest.

“They came yesterday and today, and said we should sell at N400. Anyone who sells above that will be arrested and detained,” he said.

“For now, the market is just dull, people are buying and selling cautiously.”

Other traders who spoke to TheCable from Alade market, Lagos, said the security agents came to the market, but that “everyone is still buying and selling at will”.

“If you want to sell dollars, I am buying at N440, but I don’t think I want to sell for now,” he said.

The Central Bank of Nigeria has been working on closing the gap between the parallel and the official markets, with little success so far.

The bank facilitated a deal between Travelex, an international money transfer agency and the parallel market, to ensure the gap was closed.

Travelex has been selling to BDCs at 370, giving them a premium to sell at N385 per dollar, a plan that has not worked as much as expected.

A senior CBN official, who is not authorised to speak on the matter, told TheCable, that the CBN is aware of the raid on the “illegal dealings”.

Punch Newspaper - The Head, Consumer Protection Department, CBN, Hajiya Kadija Kassim, stated this during a mentoring programme for students of the Government Secondary School, Suleja, Niger State.

The mentoring programme, which was held simultaneously in over 200 schools, was part of activities to mark the World Savings Day.

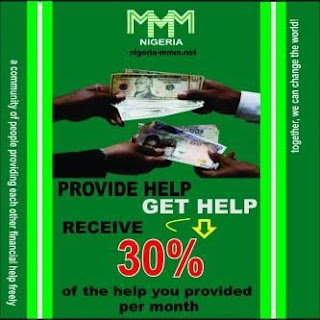

The apex bank’s warning is coming at a time when the huge unemployment situation in the country is making a lot of people to take interest in an online investment scheme tagged: ‘MMM Federal Republic of Nigeria (nigeria.mmm.net)’.

The platform has embarked on an aggressive online media campaign to lure the investing public to participate in what it called “mutual aid financial network,” with a monthly investment return of 30 per cent.

Kassim, while responding to a question asked by one of the students, described the scheme as fraudulent since it was not supported by any business model.

She said, “We have heard about the activities of MMM, but I want to warn you against it because they are wonder banks that are not regulated.

“Desist from their activities because they are fraudulent.”

She said the theme of this year’s World Savings Day, ‘Don’t save what is left after spending, but spend what is left after saving’, would assist in creating the needed awareness on the need to save.

She added, “The World Savings Day is a tradition created with the objective of stressing the importance of savings for modern economies and individuals alike.

“The primary objective is to increase awareness on financial literacy among various segments of the general public to sensitise them to the importance of saving, earning a livelihood, inculcating a savings habit, and generating employment and entrepreneurship for personal and national development.”

Subscribe to:

Posts (Atom)