The New Foreign Exchange Regime: The New Value of Naira, All You Need To Know - The CBN Explains

ThisDayLive - In what has been hailed as a bold move by market analysts in Lagos, London and Johannesburg, the Central Bank of Nigeria (CBN) wednesday unveiled the new guidelines for the Nigeria Interbank Foreign Exchange (NIFEX) Market, allowing the exchange rate of the naira to be determined by the market forces of demand and supply, although the central bank would step in whenever appropriate.

Paring the losses it made since Friday last week, the Nigerian Stock Exchange All-Share Index (NSE-ASI) rose by 3.17 per cent yesterday to close at 27,891.96, up from 27,034.05 the previous day, while market capitalisation added N279 billion to close higher at N9.579 trillion.

The new guidelines came after weeks of consultations with stakeholders including the banks on the need for a more flexible forex market, to among other things, reduce pressure on the local currency and attract foreign investors.

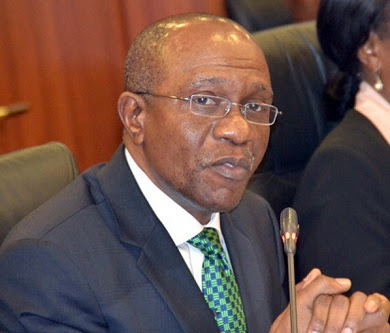

Speaking to journalists at a press briefing in Abuja, CBN Governor, Mr. Godwin Emefiele, said the central bank had resolved to henceforth deal with FX Primary Dealers (FXPDs) under the new arrangement.

He also said the existing ban of 41 items from accessing forex from the official window would remain in place.

He said part of the objectives of the new framework, which included the introduction of the naira-settled Over-the-Counter (OTC) FX Futures trading, was to discourage people from front-loading or hoarding forex due to uncertainty.

He also assured the markets that the backlog of matured letters of credit would be cleared.

Confirming THISDAY’s exclusive report yesterday that the CBN would not create a “special” window for critical transactions, Emefiele said the new forex framework would allow the market to operate as a single market structure through the interbank/autonomous window, while the exchange rate would be purely market-driven using the Thomson-Reuters Order Matching System as well as the Conversational Dealing Book.

He said the CBN would however participate in the market through periodic interventions to either buy or sell forex as the need arises.

He said to improve the dynamics of the market, the central bank would further introduce FX Primary Dealers (FXPD), who would be registered by the CBN, to deal directly with the Bank for large trade sizes on a two-way quote basis.

The governor said the primary dealers would operate with other dealers in the interbank market, among other obligations that would be stipulated in the Foreign Exchange Primary Dealers (FXPD) guidelines.

However, he said selected FX Primary Dealers would be notified by Friday, June 17, 2016 on the new guidelines while all other non-primary dealers would remain valid and eligible to participate in the market.

He said interbank trading under the new guidelines would begin on Monday, June 20, 2016, while tenors and rates for the naira-settled OTC FX Futures would be announced on June 27, 2016.

According to Emefiele, “The big point here is that we’ve decided that the CBN will deal primarily with what we call the foreign exchange primary dealers. We will have non-primary dealers and primary dealers.

“The guidelines for the qualification for being a foreign exchange primary dealer would be on our website.

“There are a number of qualifications, either the size of the bank, or the size of forex transactions it had done before, the level of liquidity, the extent to which those banks have complied with CBN guidelines, regulations in the past and their level of preparedness in terms of being able to provide all the soft and hardware that is needed to operate in a very transparent manner that can handshake with the Thompson Reuters and FMDQ software – these will be the basis.”

He said: “But from what we see, we do not think there’ll be more than a maximum of eight or 10 primary dealers. What that means is that you have what we can call Grade A dealers and you have the Grade B dealers.

“But being a Grade A dealer doesn’t confer on you any special preference other than the fact that the size of trade that the CBN is willing to deal with you would be larger than the trade for those who are going to be dealing as non-primary dealers.

“And forex dealers themselves right now and even the banks understand what we mean by the size of trade, talking about an open transparent, two-way quote system, where I can close or they can close on themselves, or me on them, and their capacity to deliver anytime within the trading period is very important here.

“So that’s why we are trying to segment them in two parts.”

Emefiele said based on what the central bank had published, the level of trades as a primary dealer would be set at a minimum of $10 million.

“So what that means is not about talking about the standard trades of those days when a dealer said it’s about $100,000 and you say, I close on you for $100,000.

“Now, we are talking about a minimum of $10 million and to do that, you have to have strong capacity, you must have prepared yourselves, you have to be ready to play with the highest level of professionalism and transparency and nobody is going to take any nonsense from you if you decide to breach the regulations or guidelines.

“And that’s the reason I said we will expect those who are going to deal here to be people who can deliver on their words. They must be people who understand the implications for whatever decisions they take regarding the size, talking of the volume and the exchange rate they decide to quote.

“It’s intended to ensure that we don’t have speculators, we don’t have rent seekers who just want to come into the market, particularly the primary market to just come and start auctioning and staking on prices against each other for what I can call private benefits,” he clarified.

On steps being taken by the CBN to narrow the gap between the official and parallel market rates, the central bank governor said: “As long as there’s one window, whatever comes out at the end of the day as the marginal rate, that rate will be the rate that will be recognised officially by the world as the rate of the naira.

“I do not expect that any other rate will be recognised in the market. But I think it’s important for me to provide a little clarification on a few issues burning in the hearts of people. And the first is what we call the OTC FX futures.

“The FX futures market is an innovation which we have introduced to moderate volatility in the foreign exchange market. It’s a situation where it makes it easy for you as a businessman to plan your business and the rate at which you want to do your business.”

He said the new flexible forex regime would also discourage speculative attacks on the naira.

According to him, “You do not have to fear that because of what is happening to crude oil prices today, that you are afraid that you may not be able to source your dollars in the next two, three, seven or nine months, and for that reason you begin to take precautionary decisions by front-loading on your foreign exchange.

“Under the new regime, you can decide that I have pegged the price of foreign exchange or I have pegged the price of my product based on an exchange rate of X and you lock yourself on to a future rate with our primary dealers or even with the non-primary dealers.

“When you lock yourself to a rate of let’s say N200 or you decide to lock yourself to a rate of say N230 or N280, as the case maybe, all you need to do is go back and do your business once you’ve locked yourself to a futures transaction through futures deal.

“So if in the next three months, if the rate you agreed at locking up your futures deal was say N260, and the market is doing say, N270 at that time, that N10 gap, the Central Bank of Nigeria will bridge the naira equivalent of that N10 gap such that you are not seen to be losing money by waiting for the next two to three months to procure your foreign exchange.”

Emefiele added that what the OTC FX futures market would do for Nigeria is that it would shift forex demand from the spot market to the time when forex is really needed, adding that demand for forex on the spot market had led to the demand pressure in the market and speculative attacks against the naira.

“Indeed, we would be engaging more and more both with the banks and primary and non-primary forex dealers about how this would work because we are determined to ensure that this works and I am very optimistic that it would work,” he said.

On the matured letters of credit, he said the current level of Nigeria’s foreign reserves should offer hope to investors.

“I know a couple of people, particularly those who have matured letters of credit, who would want to buy their foreign exchange and would demand to know what would happen to the matured transactions? The important thing is that the backlog of transactions will be taken to the market for the clearance.

“And let me say this, the CBN has foreign reserve of close to about $26.5 billion-$26.7 billion; this is certainly substantially higher than the level of any demand that is in the market.

“We are making efforts with respect to the supply of forex in the market and we are also optimistic that the steps that we have taken today will help to further deepen the market and also get foreign exchange into the market.

“We are very hopeful that this will work and we are saying independently, the CBN is working to even ensure that we improve the level of supply into the market, so the demand would be met.

“There’s no need for everybody to rush at the same time into the market: indeed, you may find yourself losing money when you rush into the market and take some emergency decisions that will hurt you, hurt your profits, hurt your balance sheet and ultimately, if you are taking a bank loan, hurt your interest charges on your bank loans. So we need to be very careful.

“And that’s the reason we’ve starting the OTC FX futures market, so that you can take it easy. If you are not too sure, go to the futures, commit yourself to a rate and you’ll find a deal – all the banks will provide you with a FX futures rate whether from one to nine months and with that, you are able to go about your business without losing sleep.

“We’ve committed ourselves to the level of guarantees to say, it’s like a bet if the rate that you get eventually at the time of your futures maturing is higher than the deal date, as we will pay you the difference.

“But if the rate on that day is lower than the deal date rate, you’ll pay us the naira equivalent,” the governor explained.

Revised Guidelines for NIFEX Market

Following Emefiele’s briefing, the CBN yesterday posted the revised guidelines for the operation of the NIFEX market on its website, stating that the CBN shall operate a single market structure through the autonomous/interbank market, i.e. the interbank forex market with the CBN participating in the market through interventions directly in the interbank market or through dynamic “Secondary Market Intervention Mechanisms”.

Furthermore, it stated that in order to promote the global competitiveness of the market, the interbank FX market would be supported by the introduction of additional risk management products offered by the CBN and authorised dealers to further deepen the market, boost liquidity and promote financial security in the market.

“Additionally, to further improve the dynamics of the market, the CBN shall introduce FX Primary Dealers (FXPDs). These shall be registered authorised dealers designated to deal with the CBN on large trade sizes on a two-way quote basis, amongst other obligations as stated in the FXPD Guidelines.

“Participants in the inter-bank FX market shall include authorised dealers, authorised buyers, oil companies, oil service companies, exporters, end-users and any other entity the CBN may designate from time to time.

“Authorised dealers shall buy and sell FX among themselves on a two-way quote basis via the FMDQ Thomson Reuters FX Trading Systems (TRFXT- Conversational Dealing), or any other system approved by the CBN.

“Authorised dealers may offer one-way quotes (bid or offer) on all products and on request to other authorised participants via the FMDQ Thomson Reuters FX Trading System (FMDQ TRFXT – Order Book System), or any other system approved by the CBN.

“The maximum spread between the bid and offer rates in the interbank market shall be determined by FMDQ OTC Securities Exchange (FMDQ) via its market organisation activities with the Financial Market Dealers Association (FMDA).

“Proceeds of foreign investment inflows and international money transfers shall be purchased by authorised dealers at the interbank rate,” it added.

However, to further deepen the FX market, in addition to the already approved hedging products referenced in the CBN “Guidelines for FX Derivatives and Modalities for CBN FX Forwards”, the new circular stated that authorised dealers are now permitted to offer naira-settled non-deliverable over-the-counter (OTC) FX Futures.

It explained that OTC FX Futures’ transactions shall be non-standardised with fixed tenors and bespoke maturity dates, adding that the OTC FX Futures sold by authorised dealers to end-users must be backed by trade transactions (visible and invisible) or evidenced investments.

“FMDQ will provide the appropriate benchmarks for the valuation and settlement of the OTC FX Futures and other FX derivatives. FX OTC Futures and Forwards will count as part of the FX positions of authorised dealers.

“To promote market liquidity, authorised dealers may apply FX spot transactions to hedge Outright Forwards, OTC FX Futures and FX Options, etc.

“Settlement amounts on OTC FX Futures may be externalised for Foreign Portfolio Investors (FPIs) with Certificates of Capital Importation. Such settlement amounts shall be evidenced by an FMDQ OTC FX Futures Settlement Advice,” the guidelines stipulated.

CBN further referenced its earlier Circular Ref: TED/FEM/FPC/GEN/01/001 dated 12th January 2015, authorised dealers, (FXPDs and non-FXPDs), a review in the daily foreign currency trading positions of banks has been made with a new limit of +0.5%/-10% of their shareholders’ funds unimpaired by losses as Foreign Currency Trading Position Limits to support their obligations as liquidity providers at the close of each business day.

“Where an authorised dealer requires a higher position limit to accommodate a customer trade, the authorised dealer shall contact the Director, Financial Markets Department.

“Where the request is assessed as valid, the director shall communicate immediate approval by text or email to the authorised dealer. Thereafter, the authorised dealer must, with 24 hours, write to the Director, Financial Markets Department who will thereafter communicate an approval in writing.

“The Director, FMD shall exercise discretion on the duration of the temporary position limit depending on the estimated defeasance period of the transaction size.

“Returns on the purchases and sales of FX shall be rendered daily to the CBN by authorised dealers. Interbank funds shall NOT be sold to Bureaux-de-Change,” it stated.

According to the CBN, participation in the FX market by the CBN shall be via: the Interbank FX Market or Secondary Market Intervention Sales (SMIS).

Guidelines for Primary Dealership in Forex Products

In a separate circular on the guidelines for primary dealership in foreign exchange products, the central bank explained that the FXPDs system is one whereby interested authorised dealers are accorded access to transact FX products directly with the CBN.

The main objectives for the establishment of primary dealership in FX products, the CBN explained are: to achieve exchange rate management policy objectives; to improve the effectiveness of CBN FX market intervention activities; and to enhance market liquidity.

In addition, it stated that the FXPDs shall be evaluated on the following qualitative criteria: strong FX trading capacity (qualified and experienced; FX dealers, strong sales teams, and wide distribution networks); deployment of all FMDQ1 Thomson Reuters FX Trading Systems or any other systems approved by the CBN; dealing room standards and a dealing room supported by independent market risk management, back-offices and effective disaster recovery plan, among others.

The FXPDs are expected to have a minimum shareholders fund unimpaired by losses of at least N200 billion; minimum of N400 billion in total foreign currency assets; and minimum liquidity ratio of 40 per cent.

“FXPDs shall have a maximum limit of +0.5%/- 10% of their shareholders’ funds unimpaired by losses as Foreign Currency Trading Position Limits. Where an FXPD requires a higher position limit to accommodate a customer trade, the FXPD shall contact the Director, Financial Markets Department.

“Where the request is assessed as valid, the director shall communicate immediate approval by text or email to the FXPD. Thereafter, the FXPD must, with 24 hours, write to the Director, Financial Markets Department who will thereafter communicate an approval in writing.

“The Director, FMD shall exercise discretion on the duration of the temporary position limit depending.

“FXPDs must have a robust business continuity plan and be able to interface with the CBN from an alternate location (Contingency Dealing Room) in the case of a disaster.

“FXPDs’ disaster recovery capabilities, as reflected in their business continuity plans and are routinely tested, should ensure continuous participation in CBN’s FX trading operations (including trading, clearing and settling) in the event of a wide-scale disruption in the FXPD’s primary place of business.

“The CBN expects FXPDs to maintain a robust compliance programme, including procedures to identify and mitigate legal, regulatory, financial, and reputational risks. Such programme should include compliance officers dedicated to the business lines relevant to the FXPD functions.

“The CBN will not designate as FXPD, any authorised dealer that is, or recently (within the last year) has been subject to financial market- related litigation or regulatory action or investigation that the CBN determines material or otherwise relevant to the potential FXPD.

“In making such determination, the CBN will consider, among other things, whether and how any such matters have been resolved or addressed and the authorised dealer’s history of such matters.

“In addition, with regard to registered FXPDs, the CBN may limit access to any or all operations, and may suspend or terminate the FXPD status of an authorised dealer, at anytime deems necessary, if it becomes the subject of, or is involved with, regulatory or legal proceedings that, in the judgment of the CBN, unfavourably impacts the FXPD relationship.

“FXPDs shall maintain such accounting and other records of their respective activities in the interbank FX markets as set forth by the CBN and other relevant regulatory authorities from time to time and render returns of trades executed with the CBN to the Bank.

“All FXPDs shall submit a weekly report of FX transactions undertaken by them in the format advised by the CBN. FXPDs shall advise CBN the authorised dealers for which they do not have PSR lines for and state the reasons why.

“FXPDs shall treat all non-public information received from the CBN and, in particular, information relating to transactions and outstanding positions with the highest degree of confidentiality. FXPDs shall not share this confidential information with any third party unless required to do so by applicable law or a court order,” the guidelines for FXPDs stipulated.

How CBN Naira-Settled OTC FX Futures Will Work

In addition, providing clarification on how the CBN Naira-settled OTC FX Futures would work, the central bank explained that the proposal of the OTC FX Futures are Non-Deliverable Forwards (i.e. a contract where parties agree to an exchange rate for a predetermined date in the future, without the obligation to deliver the underlying US dollar (notional amount) on the maturity date, i.e. the settlement date).

On maturity date, it will be assumed that both parties would have transacted at the spot FX market rate. The party that would have suffered a loss with the spot FX rate will be paid a settlement amount in naira, according to a document on the central bank’s website.

The CBN stated that it would kick off the market by acting as the seller of OTC FX Futures contracts for defined tenors, i.e. 1-month, 2-month, 3-month, 6-month, 9-month, 12-month, 18-month and 24-month.

The dollar/naira OTC FX Futures contracts will provide the CBN the opportunity to kick-start the liquidity of risk management products available to end-users in the FMDQ OTC markets.

According to the central bank, the contracts would assist the CBN to manage the volatility in the spot FX market thereby promoting stability and entrenching confidence in the FX market.

Furthermore, it explained that all OTC FX Futures contracts would be trade-backed, adding that visible, invisible and investments qualify for OTC FX Futures.

FMDQ will act as the ‘OTC FX Futures Exchange’ and its appointed agent, the Nigeria Inter-Bank Settlement System PLC (NIBSS) will clear the interbank OTC FX Futures, i.e. collect initial and variation margins and settle the party to compensate on the maturity date.

“The introduction of the OTC FX Futures market will encourage end-users to spread out their demand for spot FX deals as they are now able to lock down the exchange rates for future FX requirements. This has the potential to eradicate the constant frontloading of FX requirements and minimise the disequilibrium in the spot FX market.

“End-users will make better judgements as to the timing of accessing the spot FX market. The availability of the OTC FX Futures will improve the business planning practice of end-users and FX sellers, as the future exchange rate is guaranteed through the OTC FX Futures.

“An end-user (buyer of USD) may consider it wiser to delay the purchase of its USD requirement in the spot FX market if the spot FX rate is higher than the OTC FX Futures rate of a particular tenor. The end-user will borrow USD or obtain trade finance and simultaneously hedge its exchange rate exposure with an attractive OTC FX Futures sold by the CBN.

“At maturity of the OTC FX Futures contract, the end-user will access the spot FX market. The OTC FX Futures will be used to attract significant capital flows to the Nigerian fixed income and equity markets as returns can now be enhanced as FX exposures are hedged. Foreign Portfolio Investors (FPIs) will be able to use the OTC FX Futures for capital protection.

“The envisaged increase of supply of US Dollars due to the OTC FX Futures offered by the CBN in the spot FX market will cause the spot FX rate to moderate.

“OTC FX Futures which are non-deliverable are ideal for FPIs and even Foreign Direct Investors (FDIs). OTC FX Futures can be used when the investor wants to hedge the exchange rate risk without interest in buying outright forwards which will necessitate liquidation of its investment to pay for outright forwards.

“Banks will increase the liquidity in the OTC FX Futures market (by selling OTC FX Futures) if $/N Spot FX rate starts dropping. This may cause the Spot FX rate to drop further,” it added.

Equities Rise, Naira Remains Stable

Reacting to the adoption of a floating exchange rate regime yesterday, the Nigerian Stock Exchange All-Share Index (NSE-ASI) rose by 3.17 per cent to close at 27,891.96, up from 27,034.05 the previous day, while market capitalisation added N279 billion to close higher at N9.579 trillion.

Similarly, the volume of trading soared by 244 per cent from 170,686 million shares valued at N2.424 billion the previous day to 588.437 million shares worth N3.477 billion yesterday.

The market had recorded losses for three consecutive days starting from last Friday before the rebound yesterday. Some market analysts attributed yesterday’s rally to the central bank’s announcement on the details of the new forex guidelines.

In the parallel market, on the other hand, the rate of the naira remained stable selling at N370 to a dollar yesterday, same value at which it sold on Tuesday.

Analysts Welcome New Forex Policy

Speaking on the new NIFEX policy, the Managing Director/Chief Executive, Cowry Asset Management Limited, Mr. Johnson Chukwu, expressed satisfaction with it, saying that a flexible exchange rate would provide opportunity for inflows from other sources other than crude oil sales.

According to him, the decision to allow foreign remittances to be converted at the interbank rate as well as inflows from foreign investment would help to address the disincentive that operators and other players in those areas had witnessed in the last couple of months, forcing inflows from those sources to dry up.

“So I expect that in the medium-to-long term, but not immediately, we should begin to see improvement in inflows from other sources. I want to believe the federal government would back this up with other fiscal policies, particularly as it relates to investments and in an area like infrastructure by making the infrastructure sector attractive for private sector investments.

“That would now help drive inflows. But what the central bank has done was most expected. I think clearly, in the medium term, it would help open up the economy and help stabilise the exchange rate,” Chukwu said.

The Head of Research at SCM Capital Limited (formerly Sterling Capital), Mr. Sewa Wusu, described the decision by the central bank as a positive and good move for the economy, adding: “Although it was delayed, it is better now than never.”

“We have seen the impact of that delay on the market and by extension the economy. All the same, the adoption of flexibility around the interbank market is a policy that would help bridge the gap that had existed in the forex market in the past, particularly the gap between the official and parallel markets. We expect that gap to fizzle out.

“Now, what has been adopted is more or less a floating exchange rate, which entails that we would see the interplay of demand and supply. That would by extension determine the true value of exchange rate in the country.

“What that means is that businesses would be able to plan with respect to their forex requirements and that is very critical. It would also help reduce the volatility we have seen in the market over a long period of time.

“Also, the introduction of the futures market is a positive one. It would allow for demand to be met and apart from that, you can also hedge in your transactions. So that would help for proper business planning,” he said.

However, Wusu expressed concern over forex supply in the market considering the weak value of the country’s external reserves.

In a note to THISDAY, London-based Economist at Exotix Partners LLP, Alan Cameron, said judging from the statement, the CBN would keep the bulk of its intervention for the NDF market (forward market) while futures would also be introduced, with FMDQ acting as the platform.

“Overall, this looks like quite a bold step towards liberalisation – and certainly better than many investors’ expectations (and our own), who have seen many false dawns before.

“The key feature here is that the multiple tiers/layers have been removed – the sub-text of this decision that the president (Muhammadu Buhari) has finally recognised that multiple tiers lead to arbitrage, and arbitrage creates opportunity for fraud.

“Reading a bit deeper into things, we are also tempted to conclude that this is a sign of Buhari handing the reins of the economy (back) over to his ministers,” he added.

NEW FOREX POLICY AT A GLANCE

· Exchange rate to be determined by market forces

· Market to operate a single window through the interbank market

· CBN will intervene when appropriate

· Ban on 41 items to remain

· CBN to appoint primary forex dealers by Friday to deal on large transactions

· Primary forex dealers to have a minimum shareholding of N200bn

· CBN to offer long-tenured forex forwards

· Backlog of matured letters of credit to be cleared

· Naira-settled Over-the-Counter (OTC) Forex futures market to be introduced

· Tenors and rates for OTC FX Futures market to be announced on June 27

· Non-oil exports allowed unfettered access to export proceeds through interbank market

· Banks’ foreign currency trading positions to be reviewed

ThisDayLive - In what has been hailed as a bold move by market analysts in Lagos, London and Johannesburg, the Central Bank of Nigeria (CBN) wednesday unveiled the new guidelines for the Nigeria Interbank Foreign Exchange (NIFEX) Market, allowing the exchange rate of the naira to be determined by the market forces of demand and supply, although the central bank would step in whenever appropriate.

Paring the losses it made since Friday last week, the Nigerian Stock Exchange All-Share Index (NSE-ASI) rose by 3.17 per cent yesterday to close at 27,891.96, up from 27,034.05 the previous day, while market capitalisation added N279 billion to close higher at N9.579 trillion.

The new guidelines came after weeks of consultations with stakeholders including the banks on the need for a more flexible forex market, to among other things, reduce pressure on the local currency and attract foreign investors.

Speaking to journalists at a press briefing in Abuja, CBN Governor, Mr. Godwin Emefiele, said the central bank had resolved to henceforth deal with FX Primary Dealers (FXPDs) under the new arrangement.

He also said the existing ban of 41 items from accessing forex from the official window would remain in place.

He said part of the objectives of the new framework, which included the introduction of the naira-settled Over-the-Counter (OTC) FX Futures trading, was to discourage people from front-loading or hoarding forex due to uncertainty.

He also assured the markets that the backlog of matured letters of credit would be cleared.

Confirming THISDAY’s exclusive report yesterday that the CBN would not create a “special” window for critical transactions, Emefiele said the new forex framework would allow the market to operate as a single market structure through the interbank/autonomous window, while the exchange rate would be purely market-driven using the Thomson-Reuters Order Matching System as well as the Conversational Dealing Book.

He said the CBN would however participate in the market through periodic interventions to either buy or sell forex as the need arises.

He said to improve the dynamics of the market, the central bank would further introduce FX Primary Dealers (FXPD), who would be registered by the CBN, to deal directly with the Bank for large trade sizes on a two-way quote basis.

The governor said the primary dealers would operate with other dealers in the interbank market, among other obligations that would be stipulated in the Foreign Exchange Primary Dealers (FXPD) guidelines.

However, he said selected FX Primary Dealers would be notified by Friday, June 17, 2016 on the new guidelines while all other non-primary dealers would remain valid and eligible to participate in the market.

He said interbank trading under the new guidelines would begin on Monday, June 20, 2016, while tenors and rates for the naira-settled OTC FX Futures would be announced on June 27, 2016.

According to Emefiele, “The big point here is that we’ve decided that the CBN will deal primarily with what we call the foreign exchange primary dealers. We will have non-primary dealers and primary dealers.

“The guidelines for the qualification for being a foreign exchange primary dealer would be on our website.

“There are a number of qualifications, either the size of the bank, or the size of forex transactions it had done before, the level of liquidity, the extent to which those banks have complied with CBN guidelines, regulations in the past and their level of preparedness in terms of being able to provide all the soft and hardware that is needed to operate in a very transparent manner that can handshake with the Thompson Reuters and FMDQ software – these will be the basis.”

He said: “But from what we see, we do not think there’ll be more than a maximum of eight or 10 primary dealers. What that means is that you have what we can call Grade A dealers and you have the Grade B dealers.

“But being a Grade A dealer doesn’t confer on you any special preference other than the fact that the size of trade that the CBN is willing to deal with you would be larger than the trade for those who are going to be dealing as non-primary dealers.

“And forex dealers themselves right now and even the banks understand what we mean by the size of trade, talking about an open transparent, two-way quote system, where I can close or they can close on themselves, or me on them, and their capacity to deliver anytime within the trading period is very important here.

“So that’s why we are trying to segment them in two parts.”

Emefiele said based on what the central bank had published, the level of trades as a primary dealer would be set at a minimum of $10 million.

“So what that means is not about talking about the standard trades of those days when a dealer said it’s about $100,000 and you say, I close on you for $100,000.

“Now, we are talking about a minimum of $10 million and to do that, you have to have strong capacity, you must have prepared yourselves, you have to be ready to play with the highest level of professionalism and transparency and nobody is going to take any nonsense from you if you decide to breach the regulations or guidelines.

“And that’s the reason I said we will expect those who are going to deal here to be people who can deliver on their words. They must be people who understand the implications for whatever decisions they take regarding the size, talking of the volume and the exchange rate they decide to quote.

“It’s intended to ensure that we don’t have speculators, we don’t have rent seekers who just want to come into the market, particularly the primary market to just come and start auctioning and staking on prices against each other for what I can call private benefits,” he clarified.

On steps being taken by the CBN to narrow the gap between the official and parallel market rates, the central bank governor said: “As long as there’s one window, whatever comes out at the end of the day as the marginal rate, that rate will be the rate that will be recognised officially by the world as the rate of the naira.

“I do not expect that any other rate will be recognised in the market. But I think it’s important for me to provide a little clarification on a few issues burning in the hearts of people. And the first is what we call the OTC FX futures.

“The FX futures market is an innovation which we have introduced to moderate volatility in the foreign exchange market. It’s a situation where it makes it easy for you as a businessman to plan your business and the rate at which you want to do your business.”

He said the new flexible forex regime would also discourage speculative attacks on the naira.

According to him, “You do not have to fear that because of what is happening to crude oil prices today, that you are afraid that you may not be able to source your dollars in the next two, three, seven or nine months, and for that reason you begin to take precautionary decisions by front-loading on your foreign exchange.

“Under the new regime, you can decide that I have pegged the price of foreign exchange or I have pegged the price of my product based on an exchange rate of X and you lock yourself on to a future rate with our primary dealers or even with the non-primary dealers.

“When you lock yourself to a rate of let’s say N200 or you decide to lock yourself to a rate of say N230 or N280, as the case maybe, all you need to do is go back and do your business once you’ve locked yourself to a futures transaction through futures deal.

“So if in the next three months, if the rate you agreed at locking up your futures deal was say N260, and the market is doing say, N270 at that time, that N10 gap, the Central Bank of Nigeria will bridge the naira equivalent of that N10 gap such that you are not seen to be losing money by waiting for the next two to three months to procure your foreign exchange.”

Emefiele added that what the OTC FX futures market would do for Nigeria is that it would shift forex demand from the spot market to the time when forex is really needed, adding that demand for forex on the spot market had led to the demand pressure in the market and speculative attacks against the naira.

“Indeed, we would be engaging more and more both with the banks and primary and non-primary forex dealers about how this would work because we are determined to ensure that this works and I am very optimistic that it would work,” he said.

On the matured letters of credit, he said the current level of Nigeria’s foreign reserves should offer hope to investors.

“I know a couple of people, particularly those who have matured letters of credit, who would want to buy their foreign exchange and would demand to know what would happen to the matured transactions? The important thing is that the backlog of transactions will be taken to the market for the clearance.

“And let me say this, the CBN has foreign reserve of close to about $26.5 billion-$26.7 billion; this is certainly substantially higher than the level of any demand that is in the market.

“We are making efforts with respect to the supply of forex in the market and we are also optimistic that the steps that we have taken today will help to further deepen the market and also get foreign exchange into the market.

“We are very hopeful that this will work and we are saying independently, the CBN is working to even ensure that we improve the level of supply into the market, so the demand would be met.

“There’s no need for everybody to rush at the same time into the market: indeed, you may find yourself losing money when you rush into the market and take some emergency decisions that will hurt you, hurt your profits, hurt your balance sheet and ultimately, if you are taking a bank loan, hurt your interest charges on your bank loans. So we need to be very careful.

“And that’s the reason we’ve starting the OTC FX futures market, so that you can take it easy. If you are not too sure, go to the futures, commit yourself to a rate and you’ll find a deal – all the banks will provide you with a FX futures rate whether from one to nine months and with that, you are able to go about your business without losing sleep.

“We’ve committed ourselves to the level of guarantees to say, it’s like a bet if the rate that you get eventually at the time of your futures maturing is higher than the deal date, as we will pay you the difference.

“But if the rate on that day is lower than the deal date rate, you’ll pay us the naira equivalent,” the governor explained.

Revised Guidelines for NIFEX Market

Following Emefiele’s briefing, the CBN yesterday posted the revised guidelines for the operation of the NIFEX market on its website, stating that the CBN shall operate a single market structure through the autonomous/interbank market, i.e. the interbank forex market with the CBN participating in the market through interventions directly in the interbank market or through dynamic “Secondary Market Intervention Mechanisms”.

Furthermore, it stated that in order to promote the global competitiveness of the market, the interbank FX market would be supported by the introduction of additional risk management products offered by the CBN and authorised dealers to further deepen the market, boost liquidity and promote financial security in the market.

“Additionally, to further improve the dynamics of the market, the CBN shall introduce FX Primary Dealers (FXPDs). These shall be registered authorised dealers designated to deal with the CBN on large trade sizes on a two-way quote basis, amongst other obligations as stated in the FXPD Guidelines.

“Participants in the inter-bank FX market shall include authorised dealers, authorised buyers, oil companies, oil service companies, exporters, end-users and any other entity the CBN may designate from time to time.

“Authorised dealers shall buy and sell FX among themselves on a two-way quote basis via the FMDQ Thomson Reuters FX Trading Systems (TRFXT- Conversational Dealing), or any other system approved by the CBN.

“Authorised dealers may offer one-way quotes (bid or offer) on all products and on request to other authorised participants via the FMDQ Thomson Reuters FX Trading System (FMDQ TRFXT – Order Book System), or any other system approved by the CBN.

“The maximum spread between the bid and offer rates in the interbank market shall be determined by FMDQ OTC Securities Exchange (FMDQ) via its market organisation activities with the Financial Market Dealers Association (FMDA).

“Proceeds of foreign investment inflows and international money transfers shall be purchased by authorised dealers at the interbank rate,” it added.

However, to further deepen the FX market, in addition to the already approved hedging products referenced in the CBN “Guidelines for FX Derivatives and Modalities for CBN FX Forwards”, the new circular stated that authorised dealers are now permitted to offer naira-settled non-deliverable over-the-counter (OTC) FX Futures.

It explained that OTC FX Futures’ transactions shall be non-standardised with fixed tenors and bespoke maturity dates, adding that the OTC FX Futures sold by authorised dealers to end-users must be backed by trade transactions (visible and invisible) or evidenced investments.

“FMDQ will provide the appropriate benchmarks for the valuation and settlement of the OTC FX Futures and other FX derivatives. FX OTC Futures and Forwards will count as part of the FX positions of authorised dealers.

“To promote market liquidity, authorised dealers may apply FX spot transactions to hedge Outright Forwards, OTC FX Futures and FX Options, etc.

“Settlement amounts on OTC FX Futures may be externalised for Foreign Portfolio Investors (FPIs) with Certificates of Capital Importation. Such settlement amounts shall be evidenced by an FMDQ OTC FX Futures Settlement Advice,” the guidelines stipulated.

CBN further referenced its earlier Circular Ref: TED/FEM/FPC/GEN/01/001 dated 12th January 2015, authorised dealers, (FXPDs and non-FXPDs), a review in the daily foreign currency trading positions of banks has been made with a new limit of +0.5%/-10% of their shareholders’ funds unimpaired by losses as Foreign Currency Trading Position Limits to support their obligations as liquidity providers at the close of each business day.

“Where an authorised dealer requires a higher position limit to accommodate a customer trade, the authorised dealer shall contact the Director, Financial Markets Department.

“Where the request is assessed as valid, the director shall communicate immediate approval by text or email to the authorised dealer. Thereafter, the authorised dealer must, with 24 hours, write to the Director, Financial Markets Department who will thereafter communicate an approval in writing.

“The Director, FMD shall exercise discretion on the duration of the temporary position limit depending on the estimated defeasance period of the transaction size.

“Returns on the purchases and sales of FX shall be rendered daily to the CBN by authorised dealers. Interbank funds shall NOT be sold to Bureaux-de-Change,” it stated.

According to the CBN, participation in the FX market by the CBN shall be via: the Interbank FX Market or Secondary Market Intervention Sales (SMIS).

Guidelines for Primary Dealership in Forex Products

In a separate circular on the guidelines for primary dealership in foreign exchange products, the central bank explained that the FXPDs system is one whereby interested authorised dealers are accorded access to transact FX products directly with the CBN.

The main objectives for the establishment of primary dealership in FX products, the CBN explained are: to achieve exchange rate management policy objectives; to improve the effectiveness of CBN FX market intervention activities; and to enhance market liquidity.

In addition, it stated that the FXPDs shall be evaluated on the following qualitative criteria: strong FX trading capacity (qualified and experienced; FX dealers, strong sales teams, and wide distribution networks); deployment of all FMDQ1 Thomson Reuters FX Trading Systems or any other systems approved by the CBN; dealing room standards and a dealing room supported by independent market risk management, back-offices and effective disaster recovery plan, among others.

The FXPDs are expected to have a minimum shareholders fund unimpaired by losses of at least N200 billion; minimum of N400 billion in total foreign currency assets; and minimum liquidity ratio of 40 per cent.

“FXPDs shall have a maximum limit of +0.5%/- 10% of their shareholders’ funds unimpaired by losses as Foreign Currency Trading Position Limits. Where an FXPD requires a higher position limit to accommodate a customer trade, the FXPD shall contact the Director, Financial Markets Department.

“Where the request is assessed as valid, the director shall communicate immediate approval by text or email to the FXPD. Thereafter, the FXPD must, with 24 hours, write to the Director, Financial Markets Department who will thereafter communicate an approval in writing.

“The Director, FMD shall exercise discretion on the duration of the temporary position limit depending.

“FXPDs must have a robust business continuity plan and be able to interface with the CBN from an alternate location (Contingency Dealing Room) in the case of a disaster.

“FXPDs’ disaster recovery capabilities, as reflected in their business continuity plans and are routinely tested, should ensure continuous participation in CBN’s FX trading operations (including trading, clearing and settling) in the event of a wide-scale disruption in the FXPD’s primary place of business.

“The CBN expects FXPDs to maintain a robust compliance programme, including procedures to identify and mitigate legal, regulatory, financial, and reputational risks. Such programme should include compliance officers dedicated to the business lines relevant to the FXPD functions.

“The CBN will not designate as FXPD, any authorised dealer that is, or recently (within the last year) has been subject to financial market- related litigation or regulatory action or investigation that the CBN determines material or otherwise relevant to the potential FXPD.

“In making such determination, the CBN will consider, among other things, whether and how any such matters have been resolved or addressed and the authorised dealer’s history of such matters.

“In addition, with regard to registered FXPDs, the CBN may limit access to any or all operations, and may suspend or terminate the FXPD status of an authorised dealer, at anytime deems necessary, if it becomes the subject of, or is involved with, regulatory or legal proceedings that, in the judgment of the CBN, unfavourably impacts the FXPD relationship.

“FXPDs shall maintain such accounting and other records of their respective activities in the interbank FX markets as set forth by the CBN and other relevant regulatory authorities from time to time and render returns of trades executed with the CBN to the Bank.

“All FXPDs shall submit a weekly report of FX transactions undertaken by them in the format advised by the CBN. FXPDs shall advise CBN the authorised dealers for which they do not have PSR lines for and state the reasons why.

“FXPDs shall treat all non-public information received from the CBN and, in particular, information relating to transactions and outstanding positions with the highest degree of confidentiality. FXPDs shall not share this confidential information with any third party unless required to do so by applicable law or a court order,” the guidelines for FXPDs stipulated.

How CBN Naira-Settled OTC FX Futures Will Work

In addition, providing clarification on how the CBN Naira-settled OTC FX Futures would work, the central bank explained that the proposal of the OTC FX Futures are Non-Deliverable Forwards (i.e. a contract where parties agree to an exchange rate for a predetermined date in the future, without the obligation to deliver the underlying US dollar (notional amount) on the maturity date, i.e. the settlement date).

On maturity date, it will be assumed that both parties would have transacted at the spot FX market rate. The party that would have suffered a loss with the spot FX rate will be paid a settlement amount in naira, according to a document on the central bank’s website.

The CBN stated that it would kick off the market by acting as the seller of OTC FX Futures contracts for defined tenors, i.e. 1-month, 2-month, 3-month, 6-month, 9-month, 12-month, 18-month and 24-month.

The dollar/naira OTC FX Futures contracts will provide the CBN the opportunity to kick-start the liquidity of risk management products available to end-users in the FMDQ OTC markets.

According to the central bank, the contracts would assist the CBN to manage the volatility in the spot FX market thereby promoting stability and entrenching confidence in the FX market.

Furthermore, it explained that all OTC FX Futures contracts would be trade-backed, adding that visible, invisible and investments qualify for OTC FX Futures.

FMDQ will act as the ‘OTC FX Futures Exchange’ and its appointed agent, the Nigeria Inter-Bank Settlement System PLC (NIBSS) will clear the interbank OTC FX Futures, i.e. collect initial and variation margins and settle the party to compensate on the maturity date.

“The introduction of the OTC FX Futures market will encourage end-users to spread out their demand for spot FX deals as they are now able to lock down the exchange rates for future FX requirements. This has the potential to eradicate the constant frontloading of FX requirements and minimise the disequilibrium in the spot FX market.

“End-users will make better judgements as to the timing of accessing the spot FX market. The availability of the OTC FX Futures will improve the business planning practice of end-users and FX sellers, as the future exchange rate is guaranteed through the OTC FX Futures.

“An end-user (buyer of USD) may consider it wiser to delay the purchase of its USD requirement in the spot FX market if the spot FX rate is higher than the OTC FX Futures rate of a particular tenor. The end-user will borrow USD or obtain trade finance and simultaneously hedge its exchange rate exposure with an attractive OTC FX Futures sold by the CBN.

“At maturity of the OTC FX Futures contract, the end-user will access the spot FX market. The OTC FX Futures will be used to attract significant capital flows to the Nigerian fixed income and equity markets as returns can now be enhanced as FX exposures are hedged. Foreign Portfolio Investors (FPIs) will be able to use the OTC FX Futures for capital protection.

“The envisaged increase of supply of US Dollars due to the OTC FX Futures offered by the CBN in the spot FX market will cause the spot FX rate to moderate.

“OTC FX Futures which are non-deliverable are ideal for FPIs and even Foreign Direct Investors (FDIs). OTC FX Futures can be used when the investor wants to hedge the exchange rate risk without interest in buying outright forwards which will necessitate liquidation of its investment to pay for outright forwards.

“Banks will increase the liquidity in the OTC FX Futures market (by selling OTC FX Futures) if $/N Spot FX rate starts dropping. This may cause the Spot FX rate to drop further,” it added.

Equities Rise, Naira Remains Stable

Reacting to the adoption of a floating exchange rate regime yesterday, the Nigerian Stock Exchange All-Share Index (NSE-ASI) rose by 3.17 per cent to close at 27,891.96, up from 27,034.05 the previous day, while market capitalisation added N279 billion to close higher at N9.579 trillion.

Similarly, the volume of trading soared by 244 per cent from 170,686 million shares valued at N2.424 billion the previous day to 588.437 million shares worth N3.477 billion yesterday.

The market had recorded losses for three consecutive days starting from last Friday before the rebound yesterday. Some market analysts attributed yesterday’s rally to the central bank’s announcement on the details of the new forex guidelines.

In the parallel market, on the other hand, the rate of the naira remained stable selling at N370 to a dollar yesterday, same value at which it sold on Tuesday.

Analysts Welcome New Forex Policy

Speaking on the new NIFEX policy, the Managing Director/Chief Executive, Cowry Asset Management Limited, Mr. Johnson Chukwu, expressed satisfaction with it, saying that a flexible exchange rate would provide opportunity for inflows from other sources other than crude oil sales.

According to him, the decision to allow foreign remittances to be converted at the interbank rate as well as inflows from foreign investment would help to address the disincentive that operators and other players in those areas had witnessed in the last couple of months, forcing inflows from those sources to dry up.

“So I expect that in the medium-to-long term, but not immediately, we should begin to see improvement in inflows from other sources. I want to believe the federal government would back this up with other fiscal policies, particularly as it relates to investments and in an area like infrastructure by making the infrastructure sector attractive for private sector investments.

“That would now help drive inflows. But what the central bank has done was most expected. I think clearly, in the medium term, it would help open up the economy and help stabilise the exchange rate,” Chukwu said.

The Head of Research at SCM Capital Limited (formerly Sterling Capital), Mr. Sewa Wusu, described the decision by the central bank as a positive and good move for the economy, adding: “Although it was delayed, it is better now than never.”

“We have seen the impact of that delay on the market and by extension the economy. All the same, the adoption of flexibility around the interbank market is a policy that would help bridge the gap that had existed in the forex market in the past, particularly the gap between the official and parallel markets. We expect that gap to fizzle out.

“Now, what has been adopted is more or less a floating exchange rate, which entails that we would see the interplay of demand and supply. That would by extension determine the true value of exchange rate in the country.

“What that means is that businesses would be able to plan with respect to their forex requirements and that is very critical. It would also help reduce the volatility we have seen in the market over a long period of time.

“Also, the introduction of the futures market is a positive one. It would allow for demand to be met and apart from that, you can also hedge in your transactions. So that would help for proper business planning,” he said.

However, Wusu expressed concern over forex supply in the market considering the weak value of the country’s external reserves.

In a note to THISDAY, London-based Economist at Exotix Partners LLP, Alan Cameron, said judging from the statement, the CBN would keep the bulk of its intervention for the NDF market (forward market) while futures would also be introduced, with FMDQ acting as the platform.

“Overall, this looks like quite a bold step towards liberalisation – and certainly better than many investors’ expectations (and our own), who have seen many false dawns before.

“The key feature here is that the multiple tiers/layers have been removed – the sub-text of this decision that the president (Muhammadu Buhari) has finally recognised that multiple tiers lead to arbitrage, and arbitrage creates opportunity for fraud.

“Reading a bit deeper into things, we are also tempted to conclude that this is a sign of Buhari handing the reins of the economy (back) over to his ministers,” he added.

NEW FOREX POLICY AT A GLANCE

· Exchange rate to be determined by market forces

· Market to operate a single window through the interbank market

· CBN will intervene when appropriate

· Ban on 41 items to remain

· CBN to appoint primary forex dealers by Friday to deal on large transactions

· Primary forex dealers to have a minimum shareholding of N200bn

· CBN to offer long-tenured forex forwards

· Backlog of matured letters of credit to be cleared

· Naira-settled Over-the-Counter (OTC) Forex futures market to be introduced

· Tenors and rates for OTC FX Futures market to be announced on June 27

· Non-oil exports allowed unfettered access to export proceeds through interbank market

· Banks’ foreign currency trading positions to be reviewed