|

Showing posts with label Economy. Show all posts

Showing posts with label Economy. Show all posts

CRC Credit Bureau Ltd. Launches New Product Called 'CRC Monitor And Alerts'

News Proof 10.3.17 No comments Edit Post

By Owoola Jumoke

The service is received as an e-mail notification, with details of changes on loan records and details of searches / inquiries made on the customers.

At a well-attended ceremony to launch the product, it was revealed that the Monitors and Alerts package will provides individual subscribers with daily email notifications on any new loan record submitted to CRC by its members on the subject. And to also changes on critical loan performance components of existing loans.

Meanwhile, at a time most deposit money banks in the country today are still smarting from the losses incurred over the years as a result of toxic debts, experts have suggested useful measures by which the banks can avoid such pitfalls in 2017.

Speaking at a public forum organised by CRC Credit Bureau Limited in association with Dun and Bradstreet Credit Bureau Limited in Lagos, a cross-section of experts drawn from the financial service and related sectors observed that most of the banks were exposed to a lot of risks, especially oil and gas, whose revenue projections have been badly affected by the economic crunch.

According to ‘Tunde Popoola, Managing Director/CEO, CRC Credit Bureau Limited, the challenges confronting most of the banks is how to reduce their risk portfolio given the bad debts they incurred these past years, especially at a time they are have more risk assets.

Thankfully, he said, the CRC Credit Bureau has been able to develop fool-proof measures that can help the banks contain the incidence of bad debts.

At the risk of sounding immodest, Popoola said what banks need to do to reduce the incidence of bad debts is to be more circumspect in the way they spread risks.

“Most of the toxic debts within the banking sector happened because they were done without proper due diligence analysis as it were. But that can be taken care of with our products and services like I-CON Plus, which can help to build a good credit industry.”

Echoing similar sentiment, Mrs. Peggy Chukwuma-Nwosu, Head of Sales and Marketing at CRC Credit Bureau Limited, who gave a presentation on CRC Credit Monitors: Useful Tools to better manage Customer Loans, disclosed that the different products developed by her organisation rsets on the wing of technology.

Specifically, she said, the CRC Prospector, which is one of her company’s offerings, “Provides alternative contact information of customers you can no longer reach.”

The lead speaker, Mr. Miguel Llenas, who sits atop Dun and Bradstreet Credit Bureau Limited, a Dominican Republic-based firm with over 170 years’ experience in credit management, spoke on the theme of the ‘Mitigating Emerging Credit Risks in the Nigeria economy in 2017.’

Nigeria, he noted sadly, was passing through its worst economic woes in years because of her overreliance on a monoculture economy. “The crash in the price of crude globally, things in recent times, have gone terribly bad for the economy,” he said.

While lamenting that most banks in the country today were technically in distress because they chose to jettison core banking regulations, Llenas said: “Most Nigerian banks are not involved in serious lending, especially to the retail market.”

Raising some posers, Llenas, who boost of over three decades experience as a credit expert said: “Do banks really need a credit bureau? How do you extend credit to customers if you don’t use credit report?”

Most of the banks in the country today, he insisted, “Have swift from lending to survival mode. Most of the banks are risk averse. This is partly why the economy is not moving forward.”

Speaking further, Llenas, who has traverse over 40 countries as part of his commitment to help grow the capacity of credit bureaus, stressed that Nigerian banks have the potential to drive the economy by lending to the critical sectors, especially the retail market rather than the high end market in order to enable them better manage risks when they occur.

“With credit monitoring, and a credit score, banks and lenders alike can easily predict the future. The use of credit report has to be a powerful tool if well harnessed,” he maintained.

Very HUGE FAKE Naira Notes Flood Nigerian Markets - Ex CBN Chief Reveals

News Proof 14.2.17 No comments Edit Post

Twenty per cent of the currency in circulation is fake, a former Deputy Governor of Central Bank of Nigeria (CBN), Dr. Obadiah Mailafia, has disclosed.

Mailafia made the disclosure yesterday while speaking at the opening session of a three-day public hearing on the 2017 budget appropriation process in the National Assembly on the topic: “Public Finance in the Context of Economic Recession: Innovative Options.”

The ex-banker who said investors’ knowledge of the huge economic potential in Nigeria was the reason for the recent oversubscription of the $1 billion Eurobond sale by the federal government, adding that it was saddening that the concerned authorities appear to be oblivious of the gravity of the fake currency in circulation, which he said was highly detrimental to the growth of the economy.

According to him, when fake currencies of that magnitude circulate, original currencies become scarce, warning that “bad money chases away good money”.

Mailafia blamed the recession in Nigeria on a number of factors such as the fall in oil prices, dwindling foreign reserves, a weakening naira, negative growth, and the existing gap in public policies.

Other factors he listed were poor banking practices, the stock market crisis, speculation, regulatory failure, corruption and fraud, as well as weak macro-economic management.

He described the American depression of 1929 as one of the worst in world history, recalling that though the crisis was caused by a stock market crash, it was compounded by the myopic intervention of the U.S. government at the time, which he said increased the interest rate in the face of the recession, instead of lowering it.

Mailafia warned the federal government and financial regulators against the high interest rate regime, pointing out that it would only aggravate the nation’s economic woes.

He also warned against a hike in taxes, suggesting that the federal government should expand its income tax base by getting more people to pay taxes instead of increasing them, stating that doing so will further impede economic growth and investment.

He also narrated how the U.S. government headed by Franklin D. Roosevelt later rescued the depressed American economy by boosting consumption and building infrastructure which provided jobs, and advised the incumbent government of President Muhammadu Buhari against sustaining its excuses that it did not cause the recession, reminding it that the buck stops on its table.

He also advised the legislature and the executive to deploy the current budget process to stimulate the economy, focus on factors that can rejuvenate growth, stabilise the exchange and interest rates and simultaneously provide a stimulus package that will ensure a synergy between economic growth and the budget package.

He said it was unfortunate that the Central Bank of Nigeria (CBN) allowed the MMM Ponzi scheme to operate in Nigeria, a situation he said could be detrimental to an already crippled economy, in view of Nigerians’ gross involvement in the scheme through the withdrawal of monies with commercial banks for investment in the scheme. He described the trend as risky for banking.

He further advised the government to reposition key institutions, invest in key infrastructure that can create employment for the teeming youths as was the case in the United States, which re-invented railway operations and reduced taxation.

Also delivering a speech on “Key Challenges of Planning and Budgeting in Nigeria: A Case Study of Social Safety Net Programme Implementation in Nigeria”, Dr. Nazif Darma, of the Department of Economics, University of Abuja, blamed the stagnation in the economy on the absence of planning.

He noted that India’s economy has grown consistently for decades because the country has a history of national planning spanning 65 years.

He also canvassed the need to review the Vision 20:20202 blueprint which he said should be aligned with the Sustainable Development Goals (SDGs) of the United Nations.

Darma also echoed Mailafia on taxation, saying “this is not the time to increase taxes. You can increase the number of people that will pay taxes”.

According to him, a five-year development plan should be drawn from Vision 20:2020 plan.

In her presentation, Minister of State for Budget and National Planning, Mrs. Zainab Ahmed said the 2016 budget failed to achieve its target because of the following factors: the contraction in GDP; the fall of the oil production from the targeted 2.2 million barrels per day to 1.4 million; galloping inflation of over 18 per cent from the projected 9.8 per cent; protracted depreciation of the exchange rate from the projected N197 to $1 to N305/$, while the revenue target of 3.8 per cent only attained 2.117 per cent.

According to her, oil revenue declined sharply due to the fall in oil prices while the drop in oil production arising from the militancy in the Niger Delta compounded the situation.

She, however, said the 2017 budget was conceived to achieve economic recovery, stimulate growth, pull Nigeria out of the recession and sustain macro-economic growth, adding that the budget would expand the frontiers of private-public partnerships, provide jobs through small and medium enterprises (SMEs), create wealth, and foster social safety for the poor and vulnerable in the society.

She added that this year’s revenue projection of N4.942 trillion is 28 per cent higher than the N3.85 trillion target in 2016, with 11 per cent of the projection meant to be drawn from recovered loot and 4.9 per cent from value added tax (VAT), among other sources.

Her counterpart in the ministry, Senator Udoma Udo Udoma, who came late to the event, said in line with the submissions of Mailafia and Darma, the government had no plan to increase tax and the VAT rate but was seeking to broaden the tax base.

“I will like to talk on taxation. A view was expressed that we should not increase taxes; we should broaden the collection of taxes. That is precisely what is in the budget. There is no increase in VAT, there is no increase in the company income tax, there is no increase at all in taxes,” Udoma said.

In his submission, Minister of Agriculture, Chief Audu Ogbeh, traced the foreign exchange crisis to 1986 when he said naira was first devalued by the military regime of General Ibrahim Babangida, saying since then, the naira has been consistently devalued.

Ogbeh also supported the view on lower interest rates, saying unless economists and bankers collaborate on reducing interest rates, “a disaster lies ahead”.

However, a coalition of civil society organisations under the aegis of Citizen Wealth Platform (CWP) said it had uncovered a range of frivolous, inappropriate, unclear and wasteful expenditure proposals in the 2017 budget.

According to the group, the sum of N151.536 billion was allocated to wasteful, duplicated and needless proposals and had been identified in the budget which it wanted the National Assembly to save by striking out such proposals, some of which it said were contained in 2016 budget.

The coalition also called for a reduction of National Assembly budget of N115 billion in 2017 to N110 billion “in the spirit of the austere times and to demonstrate solidarity with the Nigerian people who are suffering and going through untold hardship”.

Harsh Economy: Helpless Buhari Bows At Last, Extends Invitations To Economic Experts For Help, See Full List

News Proof 10.11.16 No comments Edit Post

Apparently alarmed at the state of the economy, the Federal Government has invited experts to make vital inputs into its Medium Term National Economic Plan.

The experts include Prof. Akpan Ekpo; Prof. Olu Ajakaiye; Prof Joe Umoh; Dr. Obadiah Mailafia; Dr Ayo Teriba; Dr Dotun Sulaiman; Dr Ayo Salami; Mr Boda Agusto; Mr Bismarck Rewane; Mr Frank Nweke; Engr Mansur Ahmed; and Mrs Adepeju Adebajo.

The move, according to findings, is to enable the experts have a say in the budget process, with a view to making it richer and more beneficial to the nation. Vanguard learned that the experts are expected to converge on Abuja for two days, beginning tomorrow, to brainstorm on how to fine-tune the 2017-2019 Medium Term Expenditure Framework, MTEF, being developed by the Ministry of Budget and National Planning and set for publication next month.

Explaining the rationale behind the engagement of the experts, the Minister of Budget and National Planning, Senator Udoma Udo Udoma, said the outcome of the endeavour, which began with the 2016 Budget and subsequent publication of the SIP, would form the basis for the plan to be made available to the public in December this year. Udoma said: “We came in focusing on the economy, corruption and security.

An economic management team was immediately put in place with the Vice President, Prof. Yemi Osinbajo, in charge. ‘’We worked out a plan and started off with the 2016 budget to reflate the economy; then we moved on to the Strategic Implementation Plan, SIP, of the budget.”

The Minister regretted that the SIP document, which had been widely acclaimed as impressive by economic experts and international fiscal agencies, was not publicly launched with fanfare.

Having published a News item credited to current news Now that the Nigerian Custom Service has lifted ban on rice importation through the land borders, the NCS has denied the report

Below is a press statement by the service, denying the reports.

Our attention has been drawn to publications on various online platforms indicating that the Nigeria Customs Service has reversed the ban on Rice importation through the land borders. These reports were attributed to a press interview purportedly granted by the Service Public Relations Officer, Deputy-Comptroller Wale Adeniyi.

2. It has become necessary to re-state the true position in view of the confusion which these online publications may create in the industry. It is even more expedient to provide this clarification given that the fact that the Service has taken a firm position earlier in the week through a joint press conference with Stakeholders.

3. First, we like to reiterate the position that importation of Rice remains banned through our Land Borders, and we have the commitment of Partner Government Agencies and Stakeholders to enforce this restriction. While this restriction is in force, Rice imports through the Ports are still allowed subject to payment of extant charges.

4. It is equally important to restate the confidence of the Nigeria Customs Service in the ability of Nigerian Rice Producers to fill the existing sufficiency gaps in the supply of the product. The Service has noted with satisfaction the ongoing Rice Revolution undertaken by many State Governments, and Strategic Interventions by Federal Government Agencies. The Service is convinced that the bumper harvests expected from these efforts will address the supply gap in 2017. It is our belief that continuous waste of scarce forex on a commodity that can be produced locally makes no economic sense, most especially at a period of recession. The Service will therefore advocate a total Ban on Rice Importation into Nigeria with effect from 2017.

5. It is worrisome that the publications that resurfaced this weekend were being attributed to a Press interview granted in October 2015. We strongly suspect that some powerful forces behind Rice Smuggling are at work, recycling an old report under a different circumstance to create confusion. We urge Nigerians to watch out for similar antics as the firm stand on Rice smuggling will pitch their selfish interest against our national interest.

Signed

Wale Adeniyi

Public Relations Officer

For: Comptroller-General of Customs

Naira Rebounds As CBN Permits Travelex To Commence Dollar Sales To BDCs

News Proof 7.10.16 No comments Edit Post

Relief appears to have come the way of the naira, which had been under attack on the parallel market FX in the past few days as the currency strengthened to N473 to the dollar yesterday, from N475 to the dollar, it closed the previous day.

The appreciation of the naira followed the implementation of a new arrangement between the Central Bank of Nigeria (CBN) and Travelex, a global foreign exchange (forex) dealer.

Also, on the interbank FX market, the spot rate of the naira climbed to N307 to the dollar yesterday, compared to the N311 to the dollar it closed the previous day.

Clearly, the appreciation of the nation’s currency was buoyed by the announcement yesterday that Travelex would today start disbursing $15,000 to each of the 3,000 registered Bureaux De Change (BDC) operators.

President, Association of Bureau De Change Operators of Nigeria (ABCON), Aminu Gwadabe, who disclosed this yesterday, said with each of the 3,000 BDCs getting $15,000 each, a total of $45 million will flow into the system.

He lauded the CBN for authorising Travelex to take responsibility of disbursing huge dollar inflows from the diaspora estimated at $21 billion annually to BDCs.

He said the development, which was an improvement from the initially approved $10,000 weekly, would deepen dollar liquidity in the system and strengthen the naira against the dollar.

Gwadabe, said the experience and integrity of Travelex would be key in getting the dollars down to BDCs.

He urged all ABCON members and BDC operators, as a matter of urgency, to visit the apex bank’s branches in their respective zones to update or validate their en-cashers and signatories mandate card for Travelex biometric data capturing.

Gwadabe said the Travelex biometric data capturing would enable the BDCs access the International Money Transfer Operators (IMTOs)/Travelex dollars window.

He said remittances had direct positive and significant impact on consumption, investment, and demand in the country as it could be used to address short-run output shocks, and even long run growth. He said remittances tended to be stable and could increase during periods of economic downturns and natural disasters.

He commended the CBN for reaffirming the country’s commitment to building an enabling environment and level-playing field for international money transfer services to Nigeria.

He said by increasing the number of IMTOs from three to 14, the CBN under its Governor, Godwin Emefiele, would set the economy on the path of development in the medium- to long-term and also, restore integrity in the international money transfer business.

Gwadabe also commended the CBN’s efforts to strengthen the BDCs to meet the forex demand at the retail end of the market, so that they would continue to enhance employment generation in the country.

The ABCON boss was optimistic despite the challenges facing the economy, the CBN and BDCs would continue to work together and find sustainable solutions that could help the country wriggle out of the ongoing forex crisis and achieve full economic recovery.

He pledged that ABCON under his leadership would continue to ensure that purchased funds are sold to end users and on eligible transactions only, while weekly returns on purchases from the banks will be rendered to Trade and Exchange Department of the CBN. He further promised to ensure strict compliance to the provisions of the anti-money laundering laws and observance of appropriate KYC principles in the handling of forex transactions.

24 Reckless Mismanagement Of The Economy That Led Nigeria To Recession - Sunday Dare, Former Tinubu's Aide

News Proof 29.9.16 No comments Edit Post

Mr. Sunday Dare, the former media aide to the national leader of the ruling All Progressives Congress, APC, Asiwaju Bola Ahmed Tinubu has attributed Nigeria current recession to the recklessness of the former ruling Party, the Peoples Democratic Party, PDP.

The former Media aide to Tinubu, who was just appointed by President Muhammadu Buhari as the Executive Commissioner, (South West) the Nigerian Communications Commission (NCC), in facebook post quoted some tweets allegedly tweeted by Ashaka Saleh, a journalist working with Voice of America.

The post reads

"I challenge PDP to name one Country on planet earth whose treasury is disbursed in such a manner and not suffer what Nigeria is economically suffering today...Just name only one oh!!!"

"1) Ex-CDS, Alex Badeh dug a pit toilet to hide $32 million dollars2) I got order from above to pay Tompolo N13 billion for Maritime university land -Nimasa DG3) N950 million was shared in my house -Shekarau4) My boss asked me to get $11 million dollars from the CBN -Dasuki Account Officer5) The President asked me to change N10 billion to foreign currency for PDP delegates -Dasuki6) I gave N100m each to Odili, Jim Nwobodo, Bode George and others -Yuguda7) I got N2.1b from Dasuki for publicity -Dokpesi8) I got N650m from Dasuki for my Abuja burnt office -Thisday Obaigbena9) I collected N350m from Dasuki for consultation -Iyorchia Ayu10) Bafarawa collected N3 billion for spiritual purposes11) N12. 7 billon naria for deceased NEPA staff grew wings and disappeared12) Bode-George and Dabo -N100 billion naira13) Olisa Metuh took N400 million naira14) Aziboala, GEJ's cousin took N6 billion naira15) Tony Anenih - N400 million naira16) Lucky Igbinedion - N16 billion naira17) Former Air Chief Amosu - N2 billion naira18) Pastor Ayo Oritsejafor - $35 million dollars19) Olu Falae took N100 million naira20) Fayose took N3 billion naira21) Nenadi Usman took N3.5 billion naira22) Femi Fani-Kayode took N740 million naira23) Patience Jonathan is claiming $31 million dollars, she has sued the Nigerian stateAnd I add:24) No need to mention that of Diezani Alison Madueke, her cronies Kola Aluko & Jide OmokoreTweets from Voice of America Correspondent ~Ashaka Saleh"

RECESSION: Nigeria's Economy Closes To Rebound - Emir Sanusi Confirms; Hails FG, CBN On Measures, Faults Finance Minister

News Proof 22.9.16 No comments Edit Post

The Emir of Kano and former Governor of the Central Bank of Nigeria (CBN), Alhaji Muhammadu Sanusi II, among other experts in the financial services industry, wednesday backed the resolve of the Monetary Policy Committee (MPC) to retain the benchmark monetary policy rate (MPR), as well as other monetary policy tools at the end of its meeting last Tuesday.

Mrs. Kemi Adeosun, the Finance Miniter had proposed cut in interest rate as part of measure to the current recession

Sanusi also expressed optimism that the Nigerian economy was on the right path and would rebound.

The emir said this at the launch of the Nigerian Banking Report 2016 by Afrinvest West Africa Limited titled “Search for Investor Confidence” in Lagos.

The MPC held the MPR at 14 per cent, with an asymmetric window at +200 and -500 basis points at the end of its September meeting. The CBN also maintained banks’ Cash Reserve Requirement (CRR) at 22.5 per cent and the Liquidity Ratio (LR) at 30 per cent.

The decision by the MPC to retain the policy rate went against the call by the Minister of Finance, Mrs. Kemi Adeosun, who on Monday called for a reduction of the MPR in order to lower the cost of borrowing for government, individuals and businesses.

But this was rejected by the MPC on the grounds that it could worsen inflation in an environment of low productivity and could deter foreign investors who had started to show renewed interest in Nigerian financial assets, following the liberalisation of the foreign exchange market three months ago.

CBN Governor, Mr. Godwin Emefiele, said at the weekend that about $1 billion had been staked on fixed income securities by foreign investors since the central bank lifted the peg on the naira.

Sanusi said: “To be honest, when the fiscal authorities and many people in the private sector said they wanted a lower interest rate, I was concerned that the central bank would succumb to pressure. The fact that the central bank did not, shows that the central bank is beginning to reclaim its independence, which to me is a very good thing.

“I was very pleased with the MPC. In fact, I was waiting for the outcome of the meeting. When the central bank said they are not bringing the interest rate down, then I said ‘yes’, that is what I like to see. These are economic issues and you make choices.

“As an interested party and a former central banker, I can see why the central bank was not willing to reduce the interest rate at this point in time. If you lower the MPR by 100 or 200 basis points (bps), it is not going to lead to a rapid increase in credit growth. You will not see an increase in credit growth that would reverse the downward trend in output by lowering MPR by 100 or 200 bps.

“You would however further fuel inflation and you would reduce the yields on fixed income securities at a time when you are trying to attract foreign exchange.

“The immediate oxygen that this economy needs is foreign exchange and portfolio investors are important.”

He urged Nigerians to be patient and expressed optimism that the Nigerian economy would rebound.

According to him, “The last two or three MPCs ago, as far as I was concerned, the central bank got the decisions right by going to a flexible exchange rate and by tightening monetary policy.”

He pointed out that the naira is currently undervalued just like most stocks on the Nigerian Stock Exchange (NSE), but fixed income securities were offering high yields.

“Now, do we really have a flexible exchange rate? That is what we need to look at. These things require courage because some of the decisions you would take would seem to fly in your face in the first week or two.

“So, what does that tell you? If you allow people to actually come in with their dollars and sell at whatever rate, people want to buy and people see that they are going to make money on fixed income, or on equities and on currency appreciation, you will have liquidity in the market.

“Now, so long as you don’t allow that, you are not going to have the flows that you want. It is the inflow of dollars into the economy that would move the naira towards its fair value and for it to get to where you want it to be.

“It is not by fiat. The market does not accept orders. You don’t sit down and say where you want the naira to be. It would never happen because it has never happened.

“They tried that in Ghana, we have seen it in Venezuela, we also saw it in Zimbabwe. If you don’t have dollars in the system, your naira is weak, simple!

“So, the question is, how do you attract dollars? Now, are portfolio investors the final solution? No, they are not.

“But anyone who thinks that a long-term investor is going to take a 10-15-year risk in an economy where we don’t get short-term macroeconomic decisions right is wasting his time.

“You have to have the macro right. You are not going to have the IMF or World Bank or even banks invest in your bonds, because they are looking at the huge gap in macroeconomic decisions,” he added.

According to him, the past three months had been a learning process for policy makers in the country, adding that there had been a retracing of steps.

The Kano emir also expressed satisfaction that in the past few days, there had been a lot of conversation around the economy, adding that that is what is required in a nation in crisis.

“What we need to do is to understand what exactly is the macroeconomic framework within which to operate and what we seek to achieve as a nation.

“The central bank keeps high the rate of interest and it is very clear in its mind that it is keeping these rates up in order to keep yields high so as to attract dollars and with that help stabilise the currency.

“Greater inflow of dollars would help reverse step-by-step, all the missteps that had been taken in the last 18 months and get capital back.

“We need to encourage the central bank to have the courage to take that risk of implementing that document of actually going into that flexible exchange rate. Let the market work for two or three weeks and see how it will perform and you are going to have a gradual narrowing of the gap between the interbank and the parallel market rates and more liquidity in the system,” he said.

He also advised the federal government to sell down some national assets in a manner that does not hurt its strategic interest.

“We need to sell down some oil assets and sell down some refineries in a transparent manner that gives you value. You can even have the option of buying back later. But basically it helps you raise revenue,” the former CBN governor said.

Earlier, during a panel session, Prof. Pat Utomi said it had become the tradition that a new government in the country would allow things to get worse before they learn rather than building a consensus that allows the country to forge development that is sustainable.

He stated that Nigeria has a crisis of leadership. “We must be able to show a clear game plan, with some critical elements of industrial policy in areas of competitive advantage, which would be self-explanatory and attractive to investors.

“Government must be responsive to signals and not let things go out of hand before seeking out solutions and these have eluded successive governments,” Utomi said.

Also, the CEO of the Economic Associates, Dr. Ayo Teriba, pointed out that Nigeria was facing its economic challenges because of its over dependence on inflows from portfolio investors and export proceeds.

“We must learn from India that relies heavily on Diaspora remittances, which are directly invested on sovereign assets, thus providing the needed foreign exchange. We must broaden the focus, not only on foreign investors, but with confidence building policies to attract the Diasporans,” he added.

Other Experts Back CBN

Other than Sanusi and the panellists at the forum held by Afrinvest, several other international and local financial experts also threw their weight behind the CBN’s decision to leave the MPC unchanged.

Staunchly supporting the CBN’s action, financial experts and market analysts contended that the decision would ensure continued foreign inflows which, according to them, was what the country needed most at this time to pull it out of economic recession.

An economist at Exotix Partners, a leading investment firm for frontier and illiquid markets based in the United Kingdom, Alan Cameron, supported the CBN’s decision, describing it as one of the regulator’s “most sensible statement in months (and) one clear about the mandate and policy limitations”.

He believed that the naira was no longer over-valued, but rather at fair value on a real effective exchange rate basis – or perhaps significantly below (325-350 locally).

He said it would take another three to six months of high nominal yields before some cuts in 2017, if external dynamics continue to improve, noting that the MPC statement “should be confidence-building, albeit from a rather low level”.

Similarly, Senior Macroeconomic Specialist at Ecobank International, London, Gaime Nonyame, supported the rate retention by the banking system regulator.

She said the CBN could not reduce the policy rate because of inflation and could not afford to increase it because the country was already in recession.

This, she insisted, would not be desirable and encouraging to investors, who are expected to bring in the much-needed foreign currency, which Nigeria needs to get out of recession.

Also, analysts at the foreign currency trading and investment arm of Diamond Bank Plc, Uyi Ohenhen, lauded the CBN’s action. He said it was a positive development that triggered the inflow of funds into the foreign exchange market wednesday.

One of the economists that spoke with Reuters also praised the CBN for shrugging off political pressure.

“CBN’s refusal to bow to government pressure was a notable sign of the institution’s independence,” said John Ashbourne of Capital Economics.

A Senior Analyst at Delta Investments, Mr. Ken Halim, said: “The CBN’s decision was generally in line with analysts’ expectations. I would have been surprised if the CBN had cut interest rates given that the most serious challenge facing the country at the moment is the forex issue.

“Dollars are still very scarce and companies are shutting down because they can’t access FX. Cutting interest rates would have been counter-productive and discouraged foreign investors from investing in treasury bills and bonds.”

RECESSION: Obama Thanks Initially Defiant Buhari For 'Heeding To Force' To Devalue The Naira

News Proof 21.9.16 No comments Edit Post

Recalls the President of the United States, Barak Obama sometime in March 2016 vowed to force defiant President Muhammadu to ensure he devalued the Naira, having succeeded, the US President yesterday praised President Muhammadu Buhari for allowing flexibility in exchange rates, the Nation Newspaper reports this morning

He spoke during a meeting of the two leaders on the sideline of the 71 United Nations’ General Assembly in New York.

Before CBN's eventual adoption of the flexible naira exchange rate regime, President Buhari had been defiant over several calls for further devaluing the naira. Buhari then opined that the past devaluation in naira had never done the country any good.

Earlier this year, the US vowed it will press on Nigeria to adopt a more flexible foreign exchange rate to boost growth and investment in the country.

This was revealed by U.S. Assistant Secretary of State for Africa, Linda Thomas-Greenfield, who told an audience at the U.S. Institute of Peace, on Monday, that Nigeria should ensure the value of the naira currency versus the U.S. dollar was realistic.

Despite the naira flexible rate regime, Nigeria had only succeeded in going to an unprecedented recession rather than boost the economy.

the two leaders yesterday also discussed ways of countering the Boko Haram militant group.

Details of the meeting were yet to be made available last night.

President Buhari also said yesterday that the anti-corruption campaign of his administration and the economic programme of diversification will significantly address the lack of job opportunities and deprivation that make Nigerian youths vulnerable to recruitment by human traffickers.

He spoke at a meeting on Modern Slavery, hosted by British Prime Minister Theresa May on the margins of the 71st Session of the United Nations General Assembly (UNGA71).

He commended the British Prime Minister for drawing the attention of the international community to such a serious matter to coincide with a time that the global focus is on migration and refugee crisis.

He called for practical and innovative measures to address all modern day human tragedies.

2 Years Ago When Obasanjo Predicted This RECESSION As Jonathan Was RECKLESS With The Economy

News Proof 16.9.16 No comments Edit Post

Published By The Nation Newspaper On November 27, 2014 Headlined: Obasanjo warns Jonathan: economy is in big trouble

Former President Olusegun Obasanjo delivered yesterday another blistering criticism of the President Goodluck Jonathan administration, saying the “economy is in the doldrums”.

The government has been celebrating the rebasing of the economy, saying it is Africa’s biggest.

But, to Obasanjo, the economy “is in the doldrums, if not in reverse”.

He said a drastic devaluation of the Naira – a step which will hurt Nigerians —was likely. The naira was devalued on Tuesday, exchanging at N168 to the dollar. Interest rate went up to 3% from 12%.

Obasanjo challenged the government to release records of crude oil proceeds to the public.

“The fourth issue I will briefly like to comment on is the economy. What the public know or see of the economy is not what the economy truly is.

“For quite some time, the covered and the hushed up corruption has had its toll on the economy. The non-investment and disinvestment in the oil and gas sector by the major international oil companies has added its own deleterious impact.

“Our continued heavy dependence on one commodity had not adequately prepared us against any shock in that one commodity on the international plane.

The former President’s stunning verdict on the economy – that it is in doldrums – drew a thunderous ovation from the full capacity Ladi Kwali Hall of the Sheraton Hotel and Towers.

Obasanjo added: “Our inadequate protection of almost all local industries with heavy cost of energy has dealt a hard blow on most indigenous industries. The economy is in doldrums if not in reverse.

“The often-quoted GDP growth neither reflects on the living condition of most of our people nor on most of the indigenous industries and services where capacity utilization is about 50 per cent.

“We had not adequately prepared for the rainy days in the management of proceeds from oil and gas resources.

“And with crude oil purchase by the US from Nigeria going down by some 30 per cent in the last three years as a result of shale revolution, things are not looking up in the oil and gas sector and hence, in the economy.

“The International Energy Agency (IEA) has predicted that the price of oil has not bottomed yet and that the price will continue to go down through the first half of 2015, if not for the whole year.

“With shale revolution and America’s self-sufficiency in energy and possibly becoming a net exporter as well as with the prediction of IEA, we must re-strategise.

“The position may be that, in future, we will have a budget that cannot be funded. We may have to borrow to pay the salaries and allowances. Revenue allocation to states and local governments has already drastically reduced. Capital projects at all levels of government may have to be drastically cut or stopped.”

On the devaluation of the Naira, Obasanjo said it will lead to horrendous disadvantage for poor Nigerians

He said: “Sooner or later, the Naira will have to be drastically devalued without any advantage to our one commodity economy but with horrendous disadvantage to already impoverished Nigerians.

“We will all sink deeper in poverty except for those who have corruptly stashed money abroad and who will start to bring such illegal and illegitimate funds back home to harvest more Naira. All the economic gains of recent years and the rebuild of the middle class may be lost.”

To the former President, “the political will, the discipline, the ability to take the hard measures to reverse the trend will appear not to be there at the leadership level, if the understanding is not there”.

He painted a gloomy picture of the future, saying: “In the end, more businesses will close down, business men and women, entrepreneurs and investors will incur more debts. Foreign investors may temporarily stop investing in a downturn economy.

“Because of the Naira depreciation, workers, particularly in the public sector, will ask for pay increase, which may be justified but will sink us deeper in the swamp.

“The scenario, which may sound alarmist, is hard to imagine but the signs are there and it would appear that those who should act are dancing slow foxtrot while their trousers are catching fire.”

Obasanjo described the National Assembly as corrupt especially the execution of constituency projects.

He said: “Today, every aspect of our national life is riven and riddled with corruption-the Executive, the Legislature, the Judiciary, the military, the civil service, the media and the private sector.

“The legislature which shrouded its corruption in the opaque nature of its budget had been encouraged through direct payment of money to the legislature to cover up wrongs done by the Executive thereby making the Legislature fail in its oversight responsibility.

“Apart from shrouding the remunerations of the National Assembly in opaqueness and without transparency, they indulge in extorting money from departments, contractors, ministries in two ways, on the so-called oversight responsibility.

“They do similar things in their so-called enquiries. But the Executive make it worsens when they pay members of the National Assembly slush money not to investigate or to cover up misdeeds of corruption and misconduct.

“Corruption in the National Assembly also includes what they call constituency projects which they give to their agents to execute but invariably, full payment us made either little or no job done.

“Most members of the National Assembly live above the law in their misconduct and corruption.”

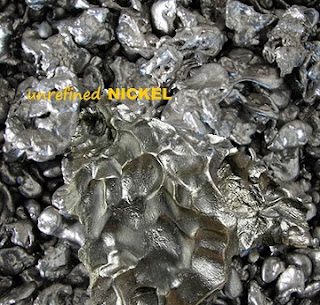

Quality Of Nickel Discovered In Nigeria Is “extraordinary” – Comet, An Australian Mining Firm

News Proof 13.9.16 No comments Edit Post

Premium Times - The abundance of native nickel balls recently discovered in Nigeria is “an extraordinary occurrence in a style not known to have been previously documented”, Comet, a private mining syndicate headed by veteran Australian miner, Hugh Morgan, has said.

In a paper distributed at the Africa Down Under Conference which held September 7 – 9 in Perth, Australia, the company said the discovery had “important implications” for nickel exploration worldwide.

The paper was delivered by the Comet team comprising Mr. Morgan, Professor Louisa Lawrence, Stephen Davis, and Steven Pragnell.

The metal named “Titan”, measuring 0.1-5.0 millimetres in diameter and weighing an estimated three weight percent, was found on the southern margin of the Jos Plateau, near the rural villages of Dangoma and Bakin Kogi, Kaduna State.

“Although the bedrock has not been tested at depth, the wide distribution of abundant nickel metal balls and their secondary ferruginous alteration product within residual weathered bedrock at Titan, indicates a highly endowed primary mineralised system,” Comet said.

“To our knowledge, this style of high-grade native nickel metal deposit has not been previously documented.”

PREMIUM TIMES had reported, last month, about the “world class and highly unusual” nickel discovery in Nigeria, ahead of the Perth conference.

Nigeria’s Minister for Solid Minerals, Kayode Fayemi, was among the speakers at the three-day event held at the Pan Pacific Hotel in Australia.

Mohammed Abbas, the permanent secretary at the ministry, said the discovery was made “many months ago” and urged the public to allow the government produce a detailed report.

The Comet team said the metal was identified and exploration commenced in early 2015.

“Pits dug up to six metres deep, at roughly 200 metre centres, show the nickel occurs in a coarse-grained micaceous felsic unit, associated with localised zones of mafic and olivine-rich ultramafic bedrocks”, the team said.

Traces of other metals such as zinc, copper, lead, and cobalt were also detected in the core and rims of the nickel.

The team said ongoing activation of major bedrock structures in the area had resulted in recent tectonic shift and exposure of fresh nickel metal at the surface in an erosional drainage basin at Titan.

“However, the nickel balls are not physically (concentrated) into a heavy mineral fraction within the soil cover sequence due to the low erosional gradient in the catchment and the freshness of the bedrock.

“Furthermore, the exposed metal balls are prevented from significant oxidation due to good drainage and the formation of a protective stable secondary oxide layer on the metal surface.”

The project area spans 20 square kilometres where high concentrations of ferruginous brown balls extend over a half a kilometre to the north and west of the nickel metal occurrence.

“Although the bedrock has not yet been tested at depth, the wide distribution of abundant nickel metal balls and their secondary ferruginous alteration product within residual weathered bedrock at Titan, indicates a large highly endowed primary mineralized system,” Comet said.

“To our knowledge, this style of high-grade native nickel metal has not been previously documented.”

It was gathered that Comet is currently focusing its exploration on developing a nickel project that targets the native nickel balls in the shallow weathered bedrock over an area of a half square kilometre.

The company is reportedly seeking funding to continue exploration and has approached a few interested parties.

Nickel is primarily sold for first use as a refined metal. About 65 percent of it, consumed in the West, is used to produce stainless steel.

The world’s largest producers of the metal include The Philippines, Indonesia, Russia, Canada, and Australia, according to the US Geological Survey.

Last month, Mr. Fayemi told Bloomberg that one of the Nigerian government’s priorities is to meet its annual steel demand of 6.8 metric tons, from a current output of less than 2.5 metric tons, produced mainly from scrap iron.

“In two to five years, we want to have started production of iron ore, lead, zinc, bitumen, nickel, coal, and gold at a serious scale,” Mr. Fayemi had said.

Rice May Sell At N40,000 Per Bag In December Unless ... - Agric Minister Predicts

News Proof 11.9.16 No comments Edit Post

Minister of State for Agriculture and Rural Development, Senator Heineken Lokpobiri, has warned that Nigeria must start producing rice by December 2016 or risk having the produce hit N40,000 per bag.

Lokpobiri said this at the weekend during a town hall meeting in Yenagoa, Bayelsa State.

He said, “For your information, we spend about $22bn a year importing food into Nigeria. We know how many more dollars they bought and that is why you see the price of rice going up.

“Price of rice was N12,000 some months ago, but it is now about N26,000 and if we don’t start producing, by December it could be N40,000.

“Rice matures in three months. So, this is a wake up call for Bayelsa people to take the four farms we have seriously. The federal government has four farms in the state in our records.

“The average land you see in Bayelsa can grow rice, so the colonial masters were not wrong in their assessment when they said Niger Delta could feed not only Nigerian but also the entire West Africa sub-region.

“Unfortunately, agriculture till today, is not a priority of the Niger Delta as far as the state governments are concerned because of oil.”

He lamented that states in the Niger Delta had yet to give priority to agriculture the way the North-West states such as Kebbi, Jigawa, Kano as well as other states like Lagos, Ebonyi, Anambra had done.

CBN Counters VP Osinbajo, Says Recession Not 100 metres Race

News Proof 10.9.16 No comments Edit Post

In contrary to Vice President Yemi Osinbajo that the current Nigeria's recession will not last long, the Central Bank of Nigeria, CBN, has asked Nigerians to brace up for the current economic recession in the country, saying that it was not a 100 metre race but a marathon.

The Vice-President, Prof. Yemi Osinbajo, has said the economic recession facing the country will not last until 2020 as predicted by a Senior Advocate of Nigeria, Olisa Agbakoba.

Osinbajo, who said this in Ede, Osun State on Thursday in an interview with journalists after the eighth convocation of the Redeemer’s University, stated that the recession would end very soon because the administration was focused on measures to revive the economy and make it strong.

He blamed the recession on destruction of oil pipelines which resulted in the reduction of crude oil being sold by the country and the drop in the price of crude oil in the international market.

Osinbajo said, “As far as we are concerned and so far as all of us who are working seriously hard are concerned, the recession must be short-lived.

But The CBN's Acting Director of Corporate Communications, Mr. Isaac Okorafor speaking in Enugu yesterday at the ongoing CBN Fair in Enugu, asked Nigerians to brace up for the current economic recession in the country, saying that it was not a 100 metre race but a marathon.

Okoroafor said that Nigerians must do this by patronising made-in Nigerian goods instead of spending hard currencies in importing items like tooth picks from China or chickens from South Africa. He however, blamed the elites for the problems pointing out that farmers eat what they produced” “We should stop importing chicken when we have them here.

Nigeria should brace up. This is not 100 metre marathon. Let us brace up and change our ways. “The most hit now are people who have refused to realise that we ought to eat what we produce, like the elite. Farmers eat what they produce,” he said.

Okoroafor stressed that the CBN had earmarked N220 billion for micro, small and medium enterprises, MSME, out of which 60 percent was meant for women and women-owned enterprises. According to him, some states have collected as much as between N2billion and N1 billion and registering corporative members in their states in bits.

“Some states elected to pay the interest which is not more than nine percent on behalf of the beneficiaries. That is a lot of guarantee and some are recording huge success.

“We also have the commercial Agricultural Credit Scheme, CACS, for larger commercial farmers. We are for everybody. One of the greatest highlights this time is the youth entrepreneurship programme and that programme is for corps members who are either in service or finished service in the last five years,” he added.

There have been interesting arguments over Minister of Finance, Kemi Adeosun’s observation that “recession is just a word,” and NAN MD, Bayo Onanuga claiming that reports of hardship in the land is exaggerated propaganda. I think we need to break down the subject further from a layman’s perspective. Recession is a word, no doubt, but it is more than a word, it is an experience: the experience that the majority of Nigerians is going through. If you are at a significant remove from that experience, it may be difficult to know how it feels, and if you are an economist, you are likely to be conveniently obsessed with textbook ideas.

Recession is when Nigerians begin to shift the traditional dates for social parties. You know we love parties a lot. Virtually every weekend, there is one party or the other, very loud celebrations where people wear the famous aso ebi, and the Naira becomes a flying object, being thrown all over the place, at the musician, the celebrant, and her friends and family, with so much joy floating in the air, and plates of jolloff rice, eaten half way and left to waste, area boys having their own share of the fun, and Nigerians showing the world that life is indeed for the living.

Sometimes, these parties make no sense: imagine a man throwing a big party to “turn the back” of his great grandfather who died 50 years ago (!) – a great grandfather he never knew, or a lavish party to celebrate the purchase of a second-hand car. Those things are very rare these days. And when some parties are held, the date on the invitation card is during the week: can you imagine being invited to a wedding on a Monday? I have seen that happen. The event was over and done with before 5 p.m. Smart way to save money in a season of recession. There were guests of course, but not the kind of crowd you’d get at a typical Nigerian party on a Friday or Saturday. The celebrants actually confessed they didn’t have the means to feed too many people. That is what recession has done. Nobody boasts anymore about “declaring surplus” – a once-upon-a-time very famous phrase in this country!

When I was much younger, my friends and I used to gate-crash parties. Bored, with not much to do, we would dress up and go from one party to the other. It was called “mo gbo mo ya” – I heard and I came. In those days, all you needed was to go to a party to which you had not been invited, and without knowing anybody, you took a seat and before long, someone would come along and ask if you had eaten. In a matter of minutes, whatever you wanted would be placed before you. Drinks? Some friends used to boast about “finishing” a carton of beer, and they would have their fill and quietly sneak away. Try that these days and you would know that recession is more than a word. Virtually every party is now strictly by invitation. Even when it is not boldly stated on the invitation card, you’d get to know the truth when you attempt to gate-crash.

Parties are now organised with such strict protocols, it is like trying to access Aso Villa. You would be screened, your bag will be checked, and don’t think it is Boko Haram attack they are afraid of, they just want to be sure you are not gate-crashing, and if you don’t have an invitation card, you would of course be turned back. There are some exceptions of course, where the protocol is a matter of security: particularly at those parties where there would be many VIPs. Nigerian VIPs don’t like to mix with just anybody.

Even if you manage to gatecrash, nobody will attend to you. What operates at parties these days, is a KYG (Know-Your-Guest) system. After sitting down, someone has to identify you as his or her guest. You don’t get served food, unless your host or hostess gives specific instructions. And you can’t drink a carton of beer anymore at your host’s expense! I certainly can’t remember when last I saw anyone getting drunk at other people’s expense at a party. Even close friends of celebrants, the ones who are a bit comfortable, go to parties these days with their own small cooler of drinks. The celebrant will offer you one or two bottles. If you want more than that, the ushers could become hostile or they could tell you pointedly: “drinks have finished.” I have had on one occasion to give the ushers, money to go and get me the drink of my choice. But once upon a time in this country, drinks don’t stop flowing at parties. The host will be so ashamed he or she would order more drinks and apologize to no end.

Where I come from, local women used to go to parties with cellophane bags, hidden away somewhere, and when they are served food, they would pull out the cellophane bag and pour food into it, all of that is done under the table. Next thing: they will start harassing the ushers: “we have not eaten here oh. Nobody has given us drinks: drinks they have moved to their collection cellophane bags! But party organisers have also learnt to be vigilant: they serve table to table; map out the space carefully and monitor the tables. Before 2019, perhaps a time will come when ushers will take your photograph, or there will be CCTV monitors at social events, just so you don’t come back and say you have not been served. That is change. That is recession. If you are a man-about-town, you can’t fail to notice this: that something has indeed changed in the social circuit. But there is that one per cent crowd, whose pockets are still so deep, if you get invited to their parties, it is like going to a surplus declaration event, what Nigerians call “too much money.” Even that is changing though, people are learning to be careful, so they don’t get invited to come and explain how they came about so much money.

Recession is when you now read in the newspapers virtually every week about people committing suicide. Nigerians are so fun-loving we were once described as the happiest people on earth. Right now, we will fail the test. Suicide used to be so rare in this country. It was considered impossible. Why would anyone want to kill himself? I used to hear people say: “eba is sweet oh, I can’t come and die” or “life is for the living” or “e go better.” People are not so sure anymore. In the past month, there have been reports about two foreigners doing business in Nigeria who have also committed suicide. Every reported suicide in recent times, has been tied, one way or the other, to the recession in the country. One man had an argument with his wife over school fees and housekeeping money and he went and ended it all. Another man actually left a note saying he had to kill himself because there is too much hardship in the country. Marriages are collapsing. Domestic violence is on the rise.

Husbands that are out of work can no longer maintain their families, they can’t pay school fees, they have become useless in their own homes, they are helpless. Their wives want to leave, even when they are not too sure of the next destination. There are at least two celebrated cases of women who have either slain their husbands or wounded them badly. In both cases, there was that notorious thing about a second woman in the background. Sharing what is not enough for one person with another woman, in a season of recession, could be a crime, but the biggest dysfunction is that of the pocket. One woman, a lawyer oh (!) stabbed her husband in the neck. Another after having sex with her husband, and putting him to sleep, got a machete and butchered him. The man is presently in what Yorubas call, “boya o ma ku, boya o maa ye” condition. Whether he would live or die is uncertain.

Recession is when companies are retrenching everyday or closing shop and SMEs are dying. In the last one year, high unemployment figures have been announced. Banks have had to shed weight; the foreign exchange crisis has forced many companies to downsize or abandon Nigeria, investors are taking their funds out of the country, many states of the Federation are so much in distress, they have stopped paying salaries. Civil servants cannot even afford a bag of rice, because their minimum wage is N18, 000 and a bag of rice is N22, 000 or higher in some places. Recession is when Nigerians now steal pots of soup and basic food items, and they can’t buy rams for Sallah, and they are told “don’t worry, change begins with you!” Every worker who has lost his or her job in the last one year is not the only one affected, the knock-on effect has brought anguish to other dependants, who now have a bread-winner behaving like a bread seeker. That is recession. That is hardship.

Recession is when enjoyment spots that used to be filled up every Friday evening are now empty. Nigerians used to celebrate what they call “Thank God it is Friday.” In Lagos, Friday evenings used to be the boys’ night. Husbands didn’t go home early. These days, husbands go home early and Fridays have become slightly boring. Recession is when prostitutes reduce their charges. I have it on good authority, from those who know, that even prostitutes have had to embrace change. And old girlfriends now demand pension benefits. Recession is when families which used to run the generator 24 hours and boast that their children can’t stand heat, have had to adjust, and run the generator only from 12 midnight, or before. Recession is when men come out and complain that their wives no longer allow them to touch them: “Are you mad? With the way things are, all you think of is sex?” Kama Sutra rites are best enjoyed only in happy lands. Recession is when in spite of all this, the breweries in Nigeria are posting unbelievable record profits and smiling to the banks. The men go home and privately drown their sorrow in bottles. Mrs. Adeosun, this is the true meaning of recession.

Subscribe to:

Posts (Atom)