Showing posts with label Nigeria National Petroleum Corporation (NNPC). Show all posts

Showing posts with label Nigeria National Petroleum Corporation (NNPC). Show all posts

PANIC As UK EXPOSES List Of Politicians, Billionaires With Foreign Properties, Accounts To FG ...You'll Be Shocked

News Proof 5.4.17 No comments Edit Post

Nigerians of “questionable characters” who own property in the United Kingdom (UK) were put on notice yesterday — they will soon be unmasked.

A criminal finances bill that will introduce the concept of “Unexplained Wealth Orders” is in the works. It is designed to close a loophole which has left the authorities powerless to seize property from overseas criminals unless such individuals are first convicted in their country of origin.

Property suspected to belong to corrupt politicians, tax evaders, and criminals could be seized by enforcement agencies under the proposed laws aimed at tackling London’s reputation as a haven for looted funds.

The Presidential Advisory Committee against Corruption hinted of the law yesterday in New York, United States (U.S.) through its Executive Secretary, Prof. Bolaji Owasanoye.

Owasanoye told the News Agency of Nigeria (NAN) that negotiations between the Federal Government and the British authorities had reached an advanced stage” to release information about Nigerians, who own property in that country next year”.

According to him, the measure being taken by the governments of both countries is aimed at stepping up the fight against corruption.

He said: “There’s no doubt that rogues in government oppress and impoverish their people by corruption and this must be sanctioned by collective action. We need to make sure that there is no safe haven for corrupt officials to run to.

“Britain has promised that by 2018, it will provide Nigeria with the information about who owns what and where; that’s very helpful.

“These include all the houses that have been bought by public officials or accounts that are held by public officials on which they are right now not paying taxes or which they cannot explain the sources.

“So, if you cannot buy a house in England, you have to look for somewhere else. But, if all countries criminalise this, then it becomes much more difficult unless you want to buy the house on Mars.”

The official said Nigeria and other African countries, who are victims of illicit financial flows, must challenge developed countries to block illicit financial flows from developing countries.

Owosanoye said: “Receiving states – the countries of the North – need to be proactive to block the proceeds of crime even before a request is made by victim countries.

“This is because, in many situations, it is clear that illegality is taking place. We think that reversing the burden of proof to improve the confiscation of criminal proceeds of crime would help, especially when we are going after the asset and not necessarily the person.

“If the person who claims to own the asset would not cooperate in giving information, then this should be a point in favour of the state.”

He contended that the burden of proof for criminal proceeds should shift to the suspects and not the government, citing the case of a former Managing Director of the Nigerian National Petroleum Corporation (NNPC).

Owasanoye said: “A former Managing Director of the NNPC was found with $9 million cash and over N70 million in his house in a small place he has built.

“He said the money is a gift. He was asked if he could tell the very generous angels who gave him this money. He’s not been able to provide that information. That sort of disposition should be used to penalise a claimant of asset who cannot justify the origin of the asset.

“The proposed ‘Unexplained Wealth Order in England,’ which hopefully we were told would pass through the legal process this year, should really help to deepen the conversation in this regard. It (Unexplained Wealth Order) would help to quickly recover assets.”

Owosanoye said research records showed that about 60 per cent of capital flight from Africa came from Nigeria because of the size of its economy.

With the ‘Unexplained Wealth Orders’, the Serious Fraud Office, HM Revenue and Customs and other agencies, will be able to apply to the High Court for an order forcing the owner of an asset to explain how he/she obtained the funds to acquire it.

The orders will apply to property and other assets worth more than £100,000. If the owner fails to demonstrate that a home or piece of jewellery was acquired using legal sources of income, agencies will be able to seize it.

The targets of the law are not just criminals, but politicians and public officials, known as “politically exposed persons”.

Depending on how quickly it passes through parliament, the bill could come into force as early as spring this year.

|

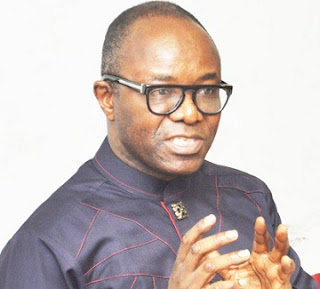

| The Newly Appointed NNPC GMD, Dr. Maikanti Baru |

Dr Maikanti Kacalla Baru attended Ahmadu Bello University, Zaria, in Kaduna State of Nigeria; where he obtained Bachelor of Engineering (Mechanical) with a first class honors. He also holds a Doctor of Philosophy in Mechanical engineering.

The presidency has appointed Dr Maikanti Kacalla Baru as Group Managing Director of Nigeria National Petroleum Corporation (NNPC). Until his appointment, Dr. Maikanti Baru was the Group Executive Director, Exploration & Production of the corporation.

Before his Recent appointment Dr Maikanti Kacalla Baru; had worked in various capacities in both the Upstream and Downstream Sectors of NNPC. These includes Group General Manager of Greenfield Refinery Projects, Managing Director of Hyson, Executive Director of Nigerian Gas Company(NGC), General Manager – Gas Division of NAPIMS, Manager – Operations, Procurement Management Services and Manager – Engineering for National Engineering and Technical Company Limited(NETCO).

During his initial stint with NAPIMS which spanned from July 1993 to July 1999, Dr. Baru executed several Gas projects which are utilizing billions of standard cubic feet of gas per day.

Several other ongoing projects were also conceptualized under his care. He planned the projects that would ensure flare-out by 2008 and made huge savings while overseeing the Joint Venture Gas Projects.

He was also the NNPC’s Chief Technical Negotiator on the West African Gas Pipeline project from July 1999 to April 2004.

Dr Maikanti Kacalla Baru has been the Chairman of NNPC Anti – Corruption Committee since September 2004 till date; and has relentlessly sensitized staff on obligations and laws that govern corruption and corrupt practices.

Dr. Baru is a fellow of the Nigerian Society of Engineers (FNSE) and a recipient of the Presidential Merit Award of the Nigerian Society of Chemical Engineers. He is married with children.

LOOT RECOVERED: 13 Names Of LOOTERS, Amount Looted Exposed From Presidency; See List

News Proof 6.6.16 3 comments Edit Post

A glimpse of likely names of some looters behind the recovered huge amount of loots has filtered barely 24 hours after the confirmation of the recovery of about N115billion, News Punch has learnt reliably

A presidency source revealed the list to The Nation Newspaper in confidence.

The names of the looters include some politically exposed persons, ex-military chiefs and some of those involved in the $115million poll bribery scandal.

The names of the looters include some politically exposed persons, ex-military chiefs and some of those involved in the $115million poll bribery scandal.

The recovered cash according to Presidency source, includes the following:

- $3.1b from Nigerian National Petroleum Corporation (NNPC) accounts (the money was paid to the oil giant by the Nigeria Liquefied Natural Gas (NLNG) Limited).

- $1m seized from a former Chief of Air Staff.

- National Broadcasting Commission (N10,061,172,600)

- Another Chief of Air Staff(N2.3b).

- An ex-presidential aide (N900m);

- A businessman (N750m);

- An ex-governor of Delta State ($15m);

- An ex-Chief of Staff and others (N420m);

- An ex-Minister (N140m);

- An ex-Military Administrator (N100m).

- Independent National Electoral Commission (INEC) officials in Oyo and Ogun (N359millon);

- A former Minister (N2m);

- A former state Speaker N1m and N580 million (£2 million) in jewelry, allegedly from a former minister.

“As soon as it is legally convenient, we will release the full list.” told The Nation

3 Main Benefits Of The Increase In Fuel Price To N145 /Litre - Kachikwu

News Proof 11.5.16 1 comment Edit Post

Following the total removal of subsidy from petroleum products today, the Minister of State for Petroleum, who also doubles as the Group Managing Director of Nigerian National Petroleum Corporation, NNPC, Mr. Ibe Kachikwu has outlined three benefits Nigerians should expect from the new petroleum product regime.

In a statement credited to the minister, Kachikwu said;

- The government expected that the new policy would “lead to improved supply and competition and eventually drive down pump prices, as we have experienced with diesel.

- “In addition, this will also lead to increased product availability and encourage investments in refineries and other parts of the downstream sector.

- “It will also prevent diversion of petroleum products and set a stable environment for the downstream sector in Nigeria.’’

The pump price of petrol in Nigeria was almost increased by 100 per cent today to N145, from N86.50, ending a fraudulent regime of subsidy that has dogged the Nigerian economy for decades.

Minister of State for Petroleum, Mr. Ibe Kachikwu said the decision was taken at the end of the stakeholders meeting presided over by Vice President Yemi Osinbajo.

According to the statement, any Nigerian is free to import the product and sell at a price not above N145 per litre.

“In order to increase and stabilise the supply of the product, any Nigerian entity is now free to import the product subject to existing quality specifications and other guidelines issued by Regulatory Agencies.

“All oil marketers will be allowed to import PMS on the basis of FOREX procured from secondary sources and accordingly PPPRA template will reflect this in the pricing of the product.

“Pursuant to this, PPPRA has informed me that it will be announcing a new price band effective today, 11th May, 2016 and that the new price for PMS will not be above N145 per litre,’’ the minister said.

Kachikwu said that the government shared the pains of Nigerians but, “the inherited difficulties of the past and the challenges of the current times imply that we must take difficult decisions on these sorts of critical national issues’’.

He said that along with the decision, the federal government had in the 2016 budget made an unprecedented social protection provisions to cushion the current challenges.

“We believe in the long term, that improved supply and competition will drive down prices.

“The DPR and PPPRA have been mandated to ensure strict regulatory compliance including dealing decisively with anyone involved in hoarding petroleum products,’’ the minister added.

The minister said that the stakeholders’ meeting had reviewed the current fuel scarcity and supply difficulties in the country and the exhorbitant prices being paid by Nigerians for the product.

He said that the meeting observed that prices ranged on the average from N150 to N250 per litre.

He said the meeting also noted that the main reason for the current problem “is the inability of importers of petroleum products to source foreign exchange at the official rate’’.

According to him, this is due to the massive decline of foreign exchange earnings of the federal government.

He said that as a result, private marketers were unable to meet their approximate 50 per cent portion of total national supply of PMS.

He said that following a detailed presentation by him, it “has now become obvious that the only option and course of action now open to the government is to take the decisions’’.

Kachikwu said the meeting had in attendance the leadership of the Senate, House of Representatives, Governors Forum, and Labour Unions .

The lifting of petroleum products at the Aba depot of the Nigeria National Petroleum Corporation (NNPC), which had been suspended sixteen years ago is expected to resume next week.

This was disclosed at the weekend as the Federal Government said it was part of measures to find permanent solution to the scarcity of fuel plaguing the country for months.

It also said over twelve million liters of petroleum products were awaiting distribution at the depot.

The resumption of operations at the depot according to the Executive Director of the company Mr. Kennedy Azodeh, followed the repairs carried out on the vandalized oil pipeline which now makes the pumping of products possible.

Suspension of loading at the depot was as a result of the continued pipeline vandalisation along the Port Harcourt – Enugu stretch covering about 209 kilometers.

Efforts in the past to revive the Osisioma Depot at Aba were sabotaged by the activities of vandals and failure of the community to ensure security of the pipelines along the route.

Azodeh said measures were being put in place to effectively check vandalism in the area.

He, however, said while the Port Harcourt –Aba route was now safe, the pumping from Aba to Enugu would be effected soon when logistics were put in place.

In his remark, Chairman of the Independent Petroleum Marketers Association ( IPMAN ) Aba Depot, Prince Bobby Dick, said because of the expected loading at the depot, marketers had reversed the price of the product to the government approved price.

Subscribe to:

Posts (Atom)