Showing posts with label Paris Club Loan. Show all posts

Showing posts with label Paris Club Loan. Show all posts

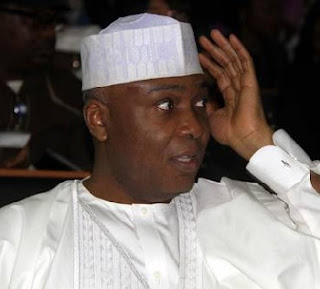

Fresh EFCC Report EXPOSED Saraki's Newest FRAUD Of N19b In Paris Club Loan, How He Used His Aides To Suck Nigeria Dry

News Proof 27.3.17 No comments Edit Post

The Economic and Financial Crimes Commission has submitted a report to President Muhammadu Buhari linking Senate President, Bukola Saraki, and some of his aides to the diversion of about N19bn from the N522bn Paris Club refund.

The report also fingered Mr. Robert Mbonu of Melrose General Services Limited.

Mbonu is a former Managing Director of Societe Generale Bank of Nigeria, the commercial bank owned by the Saraki family which was later liquidated.

The Federal Government had, in December 2016, approved the sum of N522.74bn to be paid to the 36 states of the federation as part of the reimbursement of the over-deduction on the Paris Club loan from 1995 to 2002.

The EFCC had sometimes in January discovered that the loan refunds were illegally routed through the account of the Nigeria Governors Forum by the Central Bank of Nigeria.

Upon receiving the funds, the NGF, in an alleged connivance with Saraki, began remitting huge sums to private consultants who then laundered about N19bn.

According to the report, apart from the NGF, others under investigation include the Relationship Manager to the Senate President in Access Bank, Kathleen Erhimu.

Some others under probe and identified as Saraki’s aides include Obiora Amobi, Gbenga Makanjuola, Kolawole Shittu and Oladapo Idowu.

The report alleges that sometimes in December, Saraki introduced the ex-bank MD, Mbonu, to Erhimu.

Others at the meeting were Saraki’s aforementioned aides.

It added that sequel to the meeting, the sum of N3.5bn was lodged into Melrose General Services Company account number 0005892453, domiciled in Access Bank from the Nigeria Governors Forum on December 14.

The report stated that two of Saraki’s aides, Obiora Amobi and Gbenga Makanjuola, were introduced to Access Bank as representatives of Melrose General Services Limited by Mbonu to enable them to make cash withdrawals from the account.

It added that Amobi and Makanjuola made cash withdrawals in various tranches of N5m and N10m.

The report reads in part, “Based on the foregoing findings, it is clear that Robert Mbonu, the Managing Director of Melrose General Services Company and his company were used to help divert proceeds of unlawful activities under the guise of payment for contractual obligations with the Nigeria Governors Forum.

“Suffice to apprise that all payments received by Melrose General Services Company from the NGF have hitherto been diverted directly via cash withdrawals and indirectly through transfers by Gbenga Peter Makanjuola, Kolawole Shittu and Oladapo Joseph Idowu, who are principal aides to the Senate President.

“Furthermore, other payments from Melrose General Services Company have also been linked to companies that Dr. Bukola Saraki has interest in and carries out transactions with.

“This includes the sum of $183,000, which was transferred to Bhaska Devji Jewellers, Dubai, a company Dr. Bukola Saraki had repeatedly made payments to.

“Also, the sum of N200m was transferred to Wasp Networks Limited that subsequently transferred the sum of N170m to Xtract Energy Services Limited, a company that routinely made deposits into Dr. Saraki’s Access Bank US Dollar Domiciliary account.”

The report concludes that a prima facie case of conspiracy to retain the proceeds of unlawful activities and money laundering, contrary to sections 15(3) and 18(9) of the Money Laundering Prohibition Act 2004, could be established against the aforementioned suspects.

“Additionally, investigation into their personal accounts is ongoing,” it adds.

When contacted, the Special Adviser to the Senate President on Media and Publicity, Mr. Yusuph Olaniyonu, who spoke on behalf of Saraki, said he would not react except he sighted the report.

“Send the report to me and I will be able to read it and contact the necessary people. If I don’t see the report, I cannot react to it in abstract. Send me the report if you want our reaction,” he said.

The spokesman for the EFCC, Mr. Wilson Uwujaren, confirmed that investigations were ongoing into the Paris Club scam.

He, however, said he did not know the specifics of the investigations.

“I can only confirm that there are investigations but I don’t have details,” Uwujaren said

Source: Punch Newspaper

Paris Club N388.3b Fraud: 7 Governors Involved Exposed, N500m Recovered From A Governor

News Proof 14.3.17 No comments Edit Post

The Nation - Four more suspects have been grilled over the investigation of the N19billion illegally deducted from the London-Paris Club loan refund.

Besides, about N500million of the cash has been traced to the account of a governor.

Economic and Financial Crimes Commission (EFCC) detectives are probing how the money, which was meant to pay a consultant, found its way into the yet unnamed governor’s account.

President Muhammadu Buhari will soon get an interim report on the scandal, The Nation learnt yesterday.

Seven governors allegedly played key roles in diverting part of the N388.304billion refund into two accounts opened by the Nigeria Governors Forum (NGF).

The EFCC is investigating the scam.

A source, who pleaded not to be named because he is not allowed to speak on the matter, said: “In spite of the protestation of some governors, the EFCC has decided to conclude the ongoing probe of the N19billion diverted from the loan refund.

“Detectives have grilled four more suspects and retrieved bank details on how funds were wired into some accounts.

“EFCC operatives traced about N500million, which was meant for a consultant, to the account of a governor. The cash has since been paid back after the discovery.

“The operatives are trying to determine whether or not the governor is also one of the consultants engaged for advisory service by the NGF.

“The details of how the refunds were diverted will soon be made public, especially those involved,” the source said.

Responding to a question, the source added: “The President is expected to get a status report from EFCC on the investigation.

“It is a challenging moment for EFCC but its leadership is unwavering. Some of the beneficiaries of the N19billion have vowed to frustrate the confirmation of the Acting Chairman of EFCC, Mr. Ibrahim Magu, if he goes ahead with the probe.”

A Presidency source, who spoke in confidence, said: “President Muhammadu Buhari, who is awaiting briefing, will not shield anyone implicated in the scandal.

“The President had an understanding with NGF on what the refunds should be used for. He will not spare any infractions. When he saw the diversion coming, the Presidency issued a warning.

“I think the ultimate goal of the Presidency is to recover the N19billion intact.”

Seven governors have been fingered in the alleged diversion of the cash.

Two accounts (a naira account and a domiciliary account) were used to disburse the controversial cash by the NGF.

Apart from the payment of 2 per cent of the refunds to consultants, about 3 per cent was shared out to some governors. Investigators described this as “curious”.

The Nation exclusively reported that the Presidency was uncomfortable with the attitude of some governors to the management of the refund.

The Federal Government released N388.304billion of the N522.74 billion refund to 35 states as over-deductions on the London-Paris Club loans.

States on top of the list with huge reimbursements are those controlled by the opposition Peoples Democratic Party (PDP), contrary to their claims of being oppressed by the administration of President Muhammadu Buhari.

The big earners are Akwa Ibom, Bayelsa, Rivers, Delta, Katsina, Kaduna, Lagos, Imo, Jigawa, Borno, Niger, Bauchi and Benue.

Only Kano State and the FCT did not benefit from the reimbursement.

Ondo was paid 50 per cent (N6,513,392,932.28) because the state was in a period of transition from one governor to another.

The top beneficiaries are: Akwa Ibom – N14,500,000,000.00; Bayelsa – N14,500,000,000.00; Delta—N14,500,000,000.00; Kastina -N14,500,000,000.00; Lagos – N14,500,000,000.00; Rivers

-N14,500,000,000.00; Kaduna – N14,362,416,363.24; Borno-N13,654,138,849.49; Bauchi – N12,792,664,403.93; Benue – N12,749,689,453.61; Sokoto—N11,980,499,096.97; Osun– N11,744,237,793.56; Anambra– N11,386,281,466.35; Edo– N11,329,495,462.04; Cross River – N11,300,139,741.28; Kogi – N11,211,573,328.19; and Kebbi – N11,118,149,054.10.

The Federal Government reached a conditional agreement to pay 25% of the amounts claimed subject to a cap of N14.5 billion to any given State.

Balances due thereafter will be revisited when fiscal conditions improve.

EXCLUSIVE: How Buhari Paid PDP Govs The Highest Of The Paris Club Loan; See List Of Top 17 Beneficiary States & Amount

News Proof 7.1.17 No comments Edit Post

An exclusive report by The Nation Newspaper has revealed the sum gotten by the 35 out of the 36 State from the Paris Club Loan bailout by the Federal Government.

The President Muhammadu Buhari's Government had released the sum of N388.304 billion out of N522.74 billion to 35 states as refunds of over-deductions on London-Paris Club loans.

Topping the list of states with the hugest reimbursements according to The Nation are states controlled by the opposition Peoples Democratic Party (PDP), contrary to their claims that they were being financially oppressed by the administration of President Muhammadu Buhari.

The biggest earners include Akwa Ibom, Bayelsa, Rivers, Delta, Katsina, Kaduna, Lagos, Imo, Jigawa, Borno, Niger, Bauchi and Benue states.

But the reimbursement profile has shown that some governors fed their states with wrong figures of the sums given to them.

Investigation conducted by our correspondent revealed that 35 of the 36 states benefitted from the refunds of N388.304 billion.

Although most of the governors have begged the Minister of Finance, Mrs. Kemi Adeosun, not to make the list of reimbursements public, The Nation was able to source the breakdown of the reimbursements exclusively.

The document indicated that all the 35 states were credited with their shares of the N388.304 billion as at December 27, 2016.

Our correspondent obtained the names of the bank, the account and the account numbers where each state’s share was remitted.

Only Kano State and the FCT have so far not benefitted from the reimbursements.

According to the list, Kwara State got two types of refund totaling more than N9.188 billion.

Kwara’s shares include N5,415,167,236.97 refund to the state government and N3,773,082,953.54 for its 16 local government areas.

Findings also confirmed that Ondo was only paid 50 per cent of its refunds (N6,513,392,932.28) because of leadership change in the state, which will soon lead to the inauguration of Chief Rotimi Akeredolu as the new governor.

A breakdown of the list of top beneficiaries of the refunds is as follows:

- Akwa Ibom, N14,500,000,000.00;

- Bayelsa, N14,500,000,000.00;

- Delta, N14,500,000,000.00;

- Kastina, N14,500,000,000.00;

- Lagos, N14,500,000,000.00;

- Rivers, N14,500,000,000.00;

- Kaduna, N14,362,416,363.24;

- Borno, N13,654,138,849.49;

- Bauchi, N12,792,664,403.93;

- Benue, N12,749,689,453.61;

- Sokoto, N11,980,499,096.97;

- Osun, N11,744,237,793.56;

- Anambra, N11,386,281,466.35;

- Edo, N11,329,495,462.04;

- Cross River, N11,300,139,741.28;

- Kogi, N11,211,573,328.19 and

- Kebbi, N11,118,149,054.10.

The document said: “Ondo payment represents 50 per cent of the refund due to transition of leadership in the state. Further instructions are being awaited on balance payment.

“Adamawa, Kwara 22b on the list, Oyo and Taraba payments represent the portions due to the respective local governments.”

But the Presidency was uncomfortable with the attitude of some state governors to the management of the refunds.

Responding to a question, another source in government said: “It is unfortunate that some state governors under-declared the refunds made to them.

“Some of them were also discovered to be giving spurious analysis in order to cover up the actual figures.

“In fact, some states changed the agreement overnight.

“A state said the President asked states to use at least 25 per cent of their London and Paris Club refund to offset salary arrears.”

Investigation showed that about N134.44 billion out of the approved N522.74 billion will soon be paid as refunds to some states.

The top government source added: “Yes, as at December 27, 2016, all the 35 states had received the N388.3 billion refunds. The balance of N134.44 billion will soon be accessed.”

Following protests by states against over-deductions for external debt service between 1995 and 2002, President Muhammed Buhari had on December 2, 2016 approved the release of N522.74 billion to states as refunds pending reconciliation of records.

Each state is entitled to a cap of N14.5 billion being 25 per cent of the amounts claimed.

But the government has raised a team to scrutinise claims by states and reconcile with available records.

These developments were contained in a statement issued in Abuja by the Special Adviser on Media to the Minister of Finance, Mr. Festus Akanbi.

The statement said: “The Federal Government has reached a conditional agreement to pay 25% of the amounts claimed subject to a cap of N14.5 billion to any given state. Balances due thereafter will be revisited when fiscal conditions improve.

“Mr. President’s overriding concern is for the welfare of the Nigerian people, considering the fact that many states are owing salaries and pension, causing considerable hardship.

“Therefore, to ensure compliance with the directive that a minimum of 50% of any amount disbursed is dedicated to this, funds will be credited to an auditable account from which payments to individual creditors would be made. Where possible, such payments would be made to BVN linked accounts and verified.”

But any state paid refunds in excess of its outstanding claims might suffer deduction from its monthly allocations from the Federation Account.

It said: “Due to the fact that reconciliation is still ongoing and the final outcome might show an under or overstatement of claims, an undertaken has been signed by state governors, declaring that in the event the amount already paid exceeds the verified claim, the surplus would be deducted directly from the state’s monthly FAAC allocations.

“The total amount approved by the President is N522.74 billion and is to be paid in batches. The first batch of N153.01 billion is currently being processed for release to 14 state governments.

“The release of these funds is intended to support the fiscal stimulus programme of the President Muhammadu Buhari-led administration to provide direct stimulus through government spending. It is particularly aimed at boosting demand at consumer level and reversing the slowdown in economic activity.”

Subscribe to:

Posts (Atom)